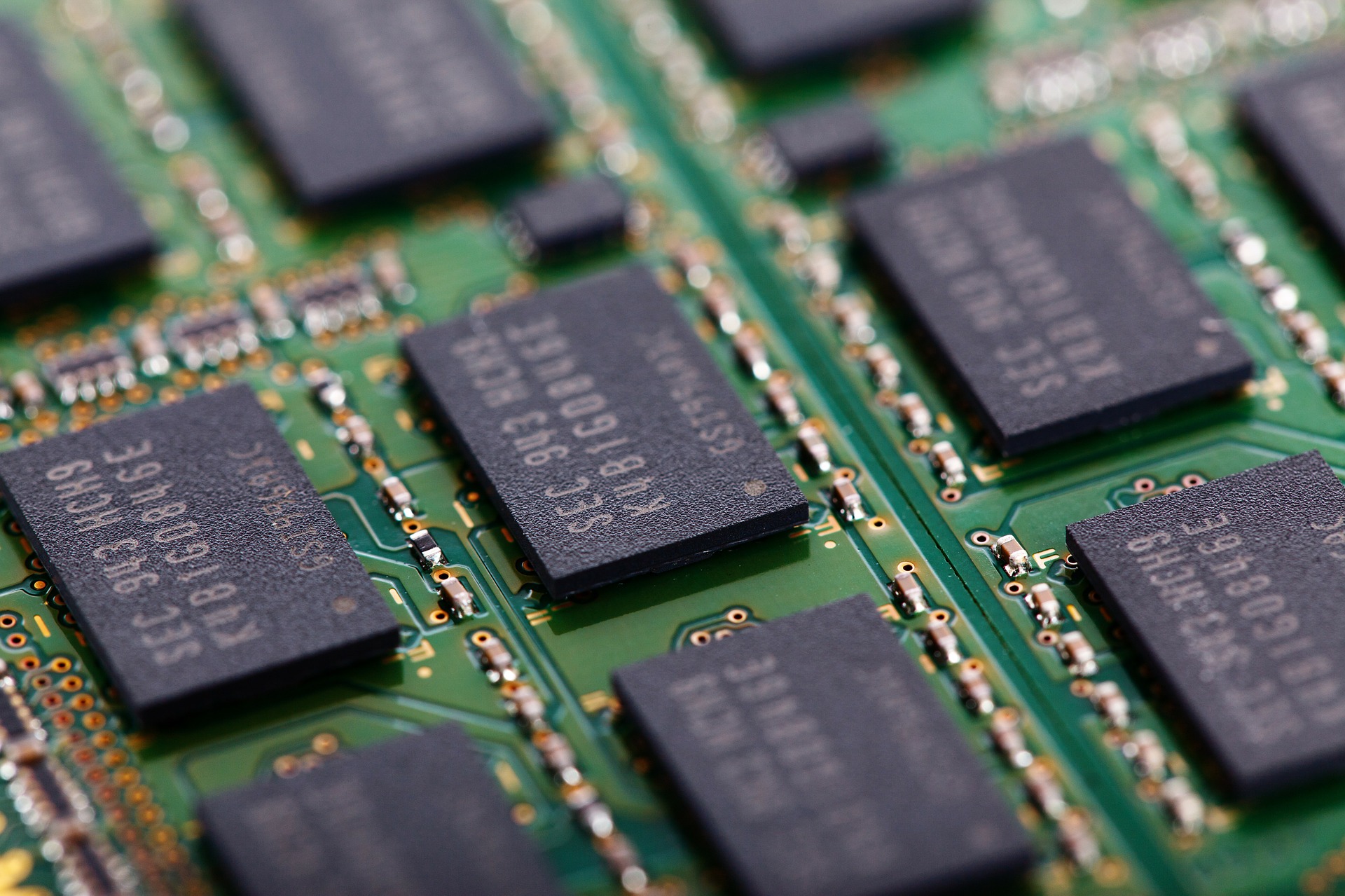

In brief: The US/China trade war and the blacklisting of Huawei are having an effect across much of the tech industry, including DRAM prices, which are now predicted to drop 25 percent over the next two quarters.

DRAMeXchange, part of analyst firm TrendForce, had predicted that DRAM prices would go down 10 percent in Q3 and 5 percent in Q4, but the Huawei situation has seen it revise these figures to 15 percent in the third quarter and 10 percent in the fourth quarter.

"As ripples from the U.S. ban continue to spread, Huawei's shipments of smartphone and server products are feared to face heavy obstacles for the next two to three quarters, impacting peak-season-demand for DRAM products 2H and the time of price precipitation," DRAMeXchange said.

DRAM prices have been falling for months now. The declining market saw Intel recently retake the 'world's largest chipmaker' throne from Samsung---a position Chipzilla lost back in Q4 2017. DRAMeXchange believes that with prices declining so much, there's a chance they could fall below suppliers "fully-loaded" costs.

"Yet, a heated U.S.-China trade war may send demand in the second half of this year into quick-freeze, with the increasingly looming uncertainty compelling datacenters to make reductions to capex. Fragile DRAM suppliers may have to admit current inventory casualties on the books by the end of this year, and officially modify their financial statements to report: 'Loss,'" wrote the firm.

It's not all doom and gloom for DRAM makers, though. DRAMeXchange believes we'll see a rebound in 2020, caused by prices hitting bottom, limited supply bit growth, and other factors. So, you might want to consider that RAM upgrade before next year.

In other Huawei news, the company has signed a deal with Russia's largest mobile provider, which will see it develop 5G networks in the country, and Facebook has just banned it from pre-installing the social network's apps.