In a nutshell: While the coronavirus has decimated many industries, some managed to weather the storm. With so many people working and studying from home, the PC market grew during the second quarter following a sharp decline in Q1.

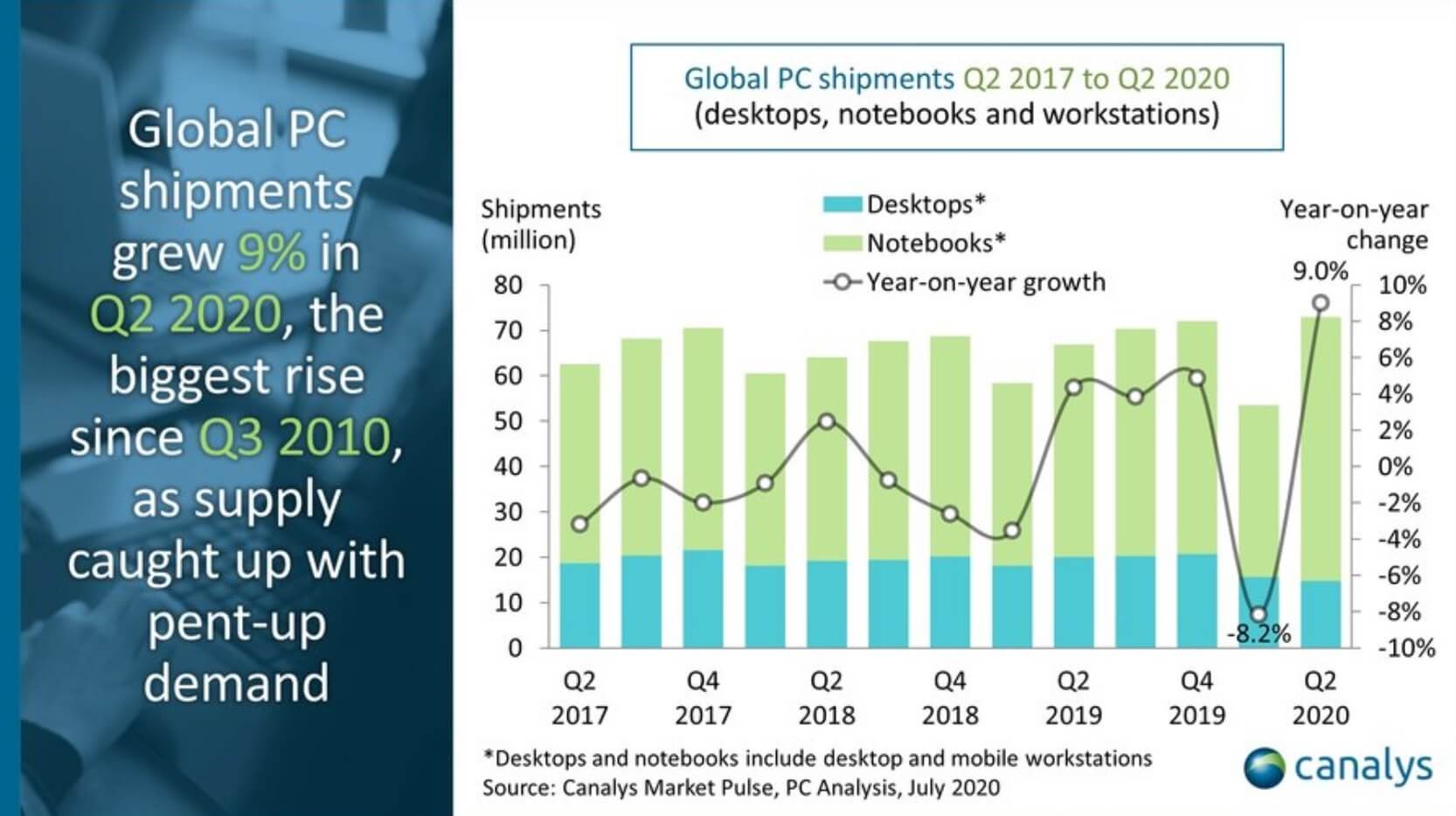

With Intel experiencing CPU shortages and factories in China closing due to lockdown requirements, PC shipments were down between eight and twelve percent in the first quarter of the year, marking the worst quarter since 2013. But as the manufacturing plants reopened and more people began working remotely, the market saw an upturn.

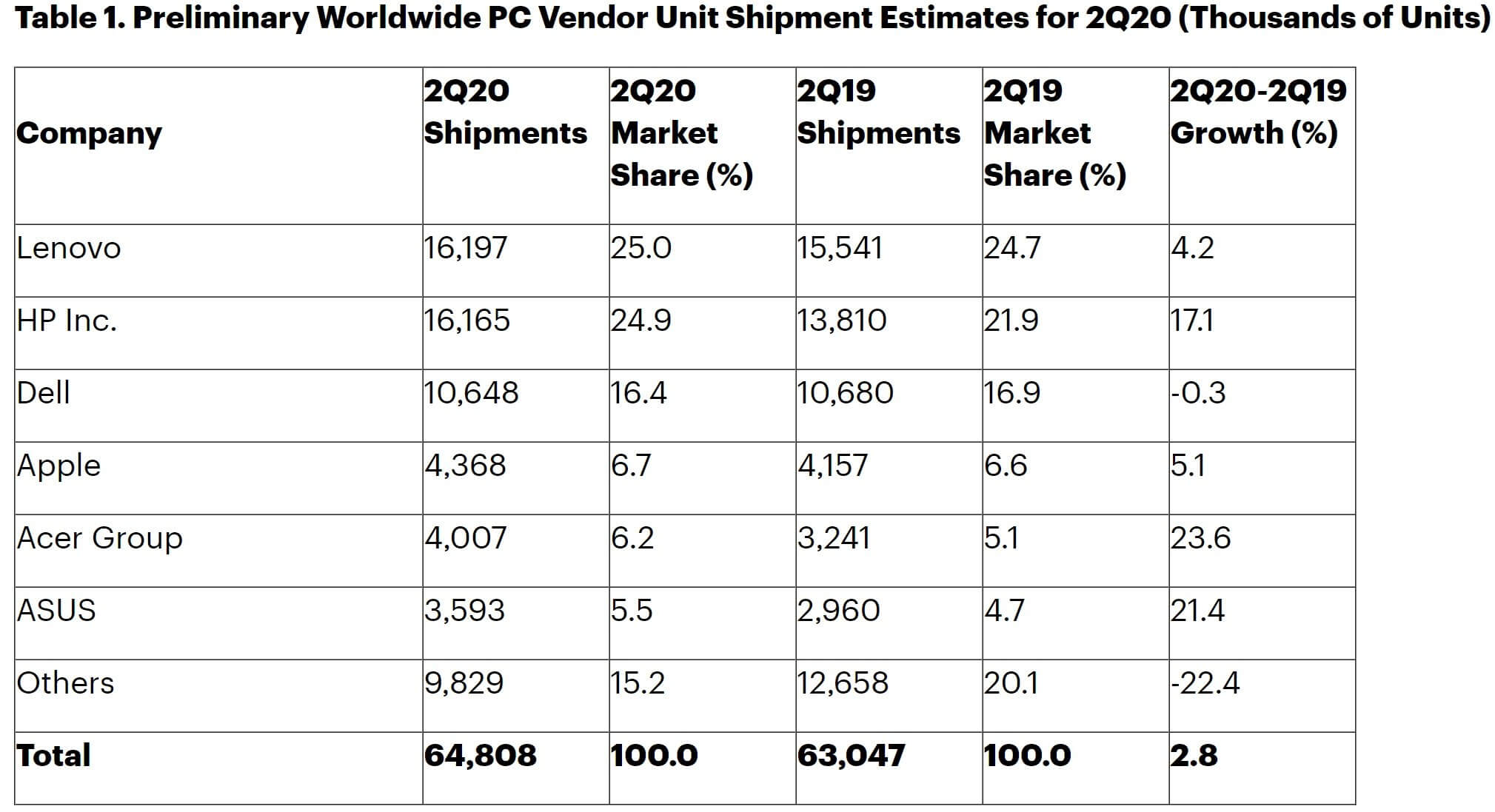

Analyst firms IDC and Gartner have both reported growth in PC shipments during Q2. IDC places the increase at 11.2 percent, reaching 72.3 million units, while Gartner has it at 2.8 percent and 64.8 million units.

It's worth noting that Gartner does not include Chromebooks in its figures, whereas IDC does. Another analyst firm, Canalys, reports that notebook shipments (including Chromebooks) grew 24 percent year-on-year while desktop shipments were down 26 percent YoY. It has the global PC market growing by 9 percent in Q2.

"Notebooks have singlehandedly pulled the PC market out of depression," said Rushabh Doshi, a research director at Canalys.

As for which is the number one PC vendor, it depends on who you ask. IDC and Canalys both name HP, while Gartner places Lenovo slightly ahead. All firms agree that HP had the larger growth, over 17 percent. Apple also saw significant YoY growth, and is fourth on all analysts' tables.

The surge comes as Microsoft reported an increase in demand for PCs in April, followed by a huge increase in Windows usage in May. Windows and Devices chief product officer Panos Panay said that "over 4 trillion minutes are being spent on Windows 10 a month, a 75% increase year on year."

The question now is whether the strong performance can continue or if the looming recessions will hit the industry.

"The strong demand driven by work-from-home as well as e-learning needs has surpassed previous expectations and has once again put the PC at the center of consumers' tech portfolio," said Jitesh Ubrani, research manager for IDC's Mobile Device Trackers. "What remains to be seen is if this demand and high level of usage continues during a recession and into the post-COVID world since budgets are shrinking while schools and workplaces reopen."