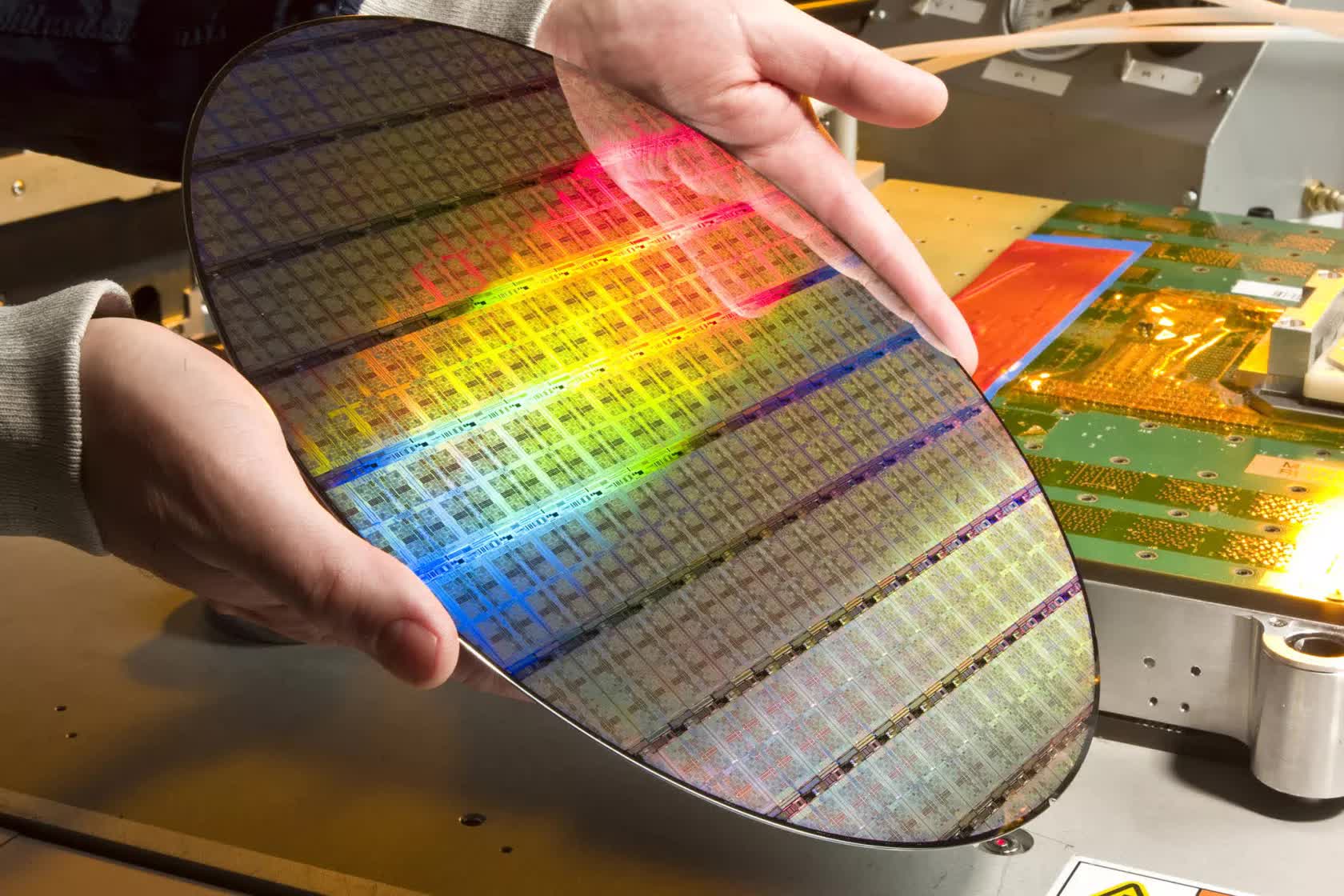

The big picture: Europe currently accounts for just ten percent of the global semiconductor industry, but the European Commission is looking to double that over the next decade. This will involve billions in funding for R&D, as well as the construction of local foundries, both of which are crucial components in the EU's plan to reshore production of electronics.

Earlier this month, the European Union was considering the idea of building a semiconductor foundry in the region in an attempt to bring chip production closer to local tech companies. Details about the project are scarce, but we do know the EU is aiming to produce chips on advanced process nodes, from 7 nm down to 3 nm and 2 nm.

The main reason is simple enough – China and the US are stuck in a perpetual trade war and that is seen as a great opportunity to invest in what has traditionally been a weak point for Europe. The region is heralded for its plane and auto industries, but at the same time accounts for just ten percent of the world's semiconductor industry, which is valued at $533 billion. For reference, the US holds about 47 percent, while China, Japan, Taiwan, and South Korea account for a combined 40 percent.

In 2020, lockdowns had a big impact on the tech supply chain, and this in turn affected US tech giants that were dependent on chips and other components made in Asia for their products.

Coupled with an unprecedented demand for consumer electronics, this created a ripple effect that is now forcing automakers to scale back production just as car sales were starting to recover. The Biden administration is trying to address the problem, but ultimately this has sent a strong signal to the European Commission that technological self-sufficiency is now more important than ever.

After all, Dutch manufacturer ASML makes 62 percent of the advanced lithography equipment that is used by all chipmakers in the world...

China knows this, and has been trying to spearhead the development of its local semiconductor industry to ensure that it will not have to rely on others for building and maintaining its public infrastructure, or for consumer electronics. European governments have also been pushing initiatives to build more local R&D and production capacity, and the latest hinges on €145 billion ($175 billion) from the bloc's Recovery and Resilience Funds.

However, for Europe to succeed in becoming a true force in the semiconductor industry, it will need to execute the first step as soon as possible. After all, Dutch manufacturer ASML holds what is essentially a monopoly on one of the critical links in the supply chain – it makes 62 percent of the advanced lithography equipment that is used by all chipmakers in the world. Launching a European alliance on semiconductor manufacturing would also help, since there is no clear consensus between the industry and policymakers as to what's actually possible to achieve in the next ten or twenty years.