In brief: US sanctions on Chinese semiconductor manufacturers have hit companies from both countries in the pocket, but Japanese firms have benefitted from the situation. A new report says used equipment dealers in Japan have seen their prices rise 20 percent since last year as Chinese firms snap up machines not subject to US restrictions.

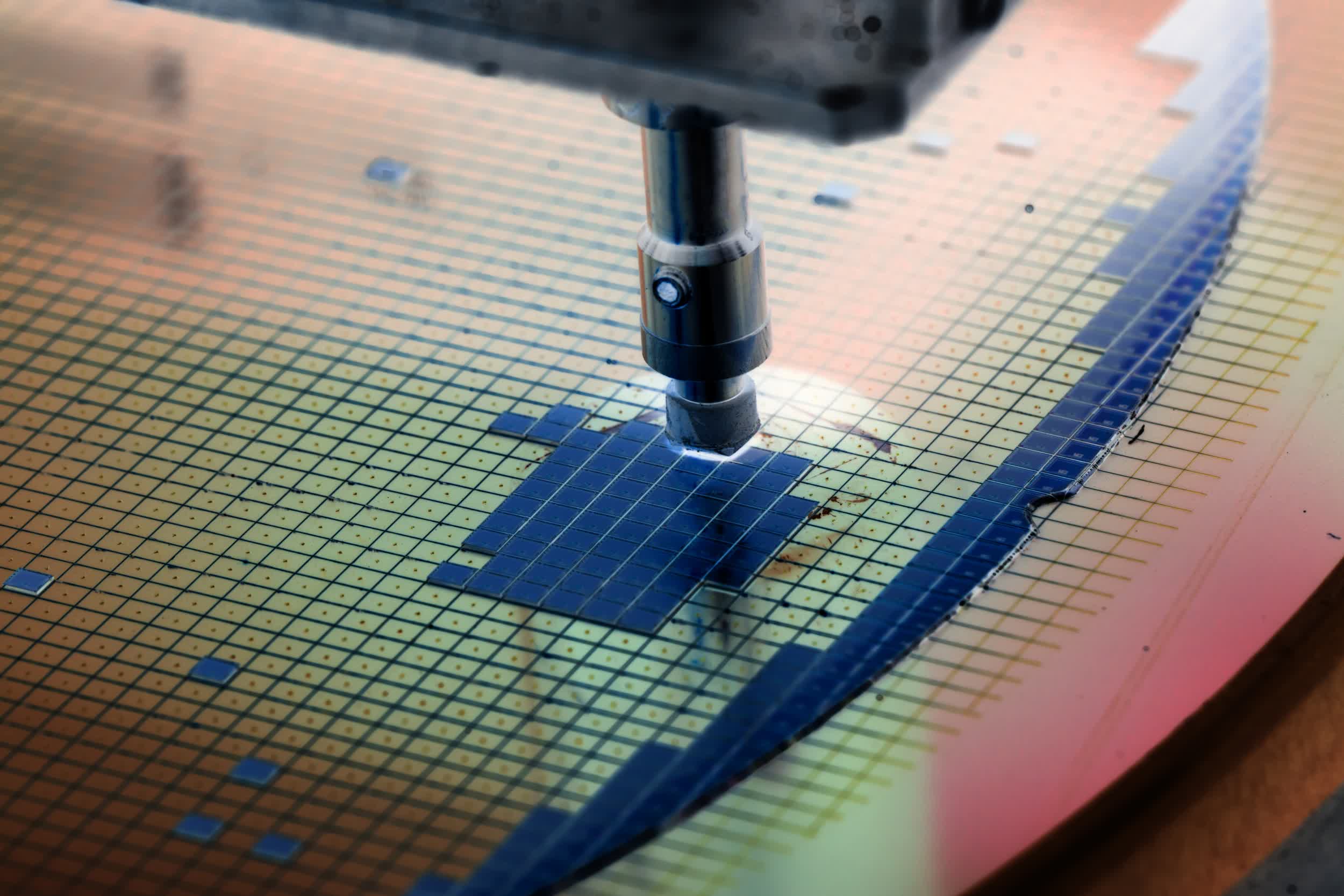

Nikkei Asia writes that Chinese semiconductor makers are turning to Japan for used equipment in the wake of US sanctions, sending up prices in the country's second-hand market. With the worldwide chip shortage still causing supply problems across multiple industries, even older, out-of-date machines are selling fast; this has seen the price of core equipment such as lithography systems increase threefold.

"Nearly 90% of used machines appear to be headed to China," said a source at Mitsubishi UFJ Lease & Finance. A used equipment dealer added, "Machines that were basically worthless several years ago are now selling for 100 million yen [$940,000]."

Wafer capacity leaders

| Company | Monthly wafer manufacturing capacity | Total global capacity share |

| Samsung | 3.1 million | 14.7% |

| TSMC | 2.7 million | 13.1% |

| Micron Technology | 1.9 million+ | 9.3% |

| SK Hynix | ~1.85 million | 9% |

| Kioxia | 1.6 million | 7.7% |

| Intel | 884,000 | ~4.1% |

In September, the US government placed sanctions on China's largest chipmaker, Semiconductor Manufacturing International Corporation (SMIC). It was also added to the same Entity list as Huawei, meaning US companies must secure a license before exporting certain products to SMIC.

While much of the used equipment is moving straight from Japan to the buyers' factory floors, some older-generation machines are being hoarded---not that the sellers care. The end goal is for the Chinese semiconductor industry to lower reliance on US imports, thereby ensuring sanctions have less impact.