A hot potato: We know that one reason it's almost impossible to find a new graphics card right now is miners grabbing them to take advantage of high crypto prices. According to Jon Peddie Research (JPR), however, buying a high-end card for mining would be "very foolish."

In JPR's latest report on the PC market, it notes that "the pandemic has distorted all models and predictions as has the gold-rush in Ethereum."

The report reveals that total GPU shipments were up more than 20 percent in the fourth quarter of 2020, jumping 12.4 percent year-over-year.

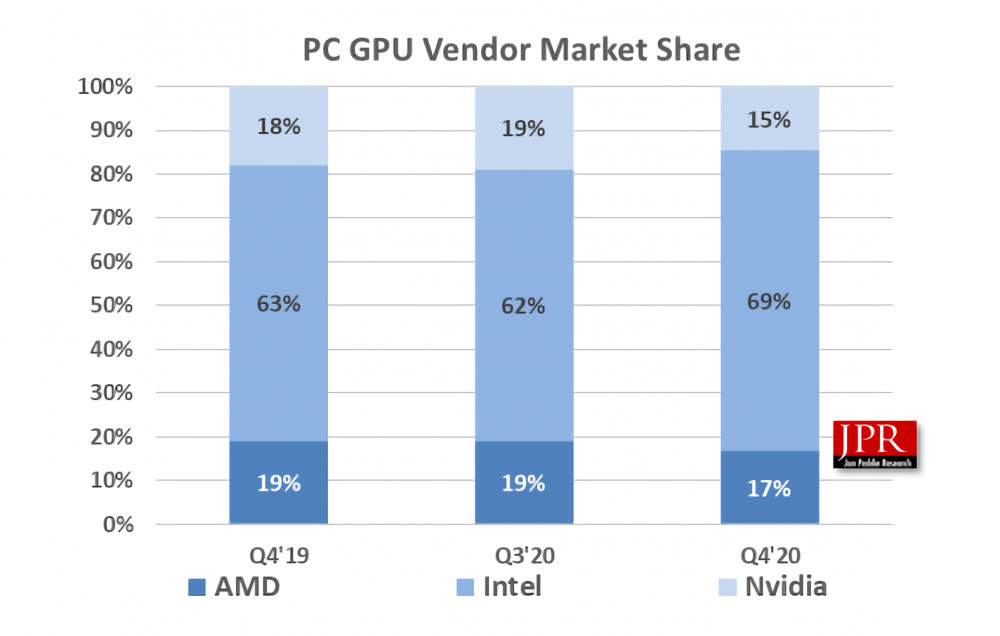

It's important to note that the figures include integrated graphics, which is why Intel takes a 69% share of the market. AMD's QoQ shipments increased 6.4%, giving it a 17% share, while Nvidia's decreased 7.3%, dropping its share to 15%.

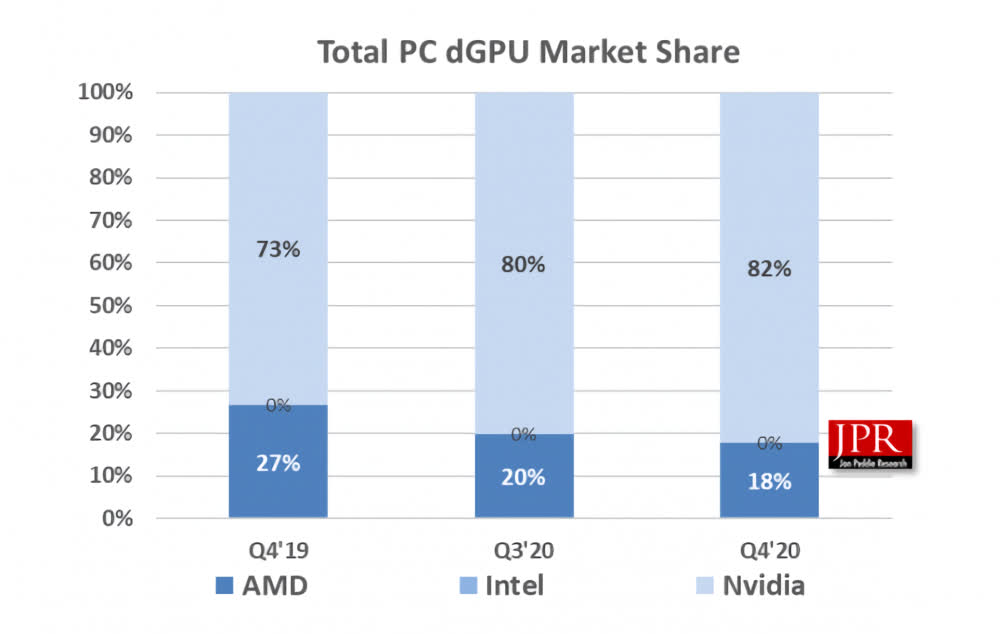

It's a different story when looking solely at dedicated graphics cards. The market decreased 3.9% from the last quarter, with Nvidia taking an 82% share, dwarfing AMD's 18% share. JPR says the fourth quarter is typically flat compared to Q3, so this is normal.

The pandemic is highlighted as a factor behind the demand for AIB cards across the last two quarters, but crypto mining also played a part. The market research firm has a dire warning for miners eying a powerful graphics card.

"The power consumption of AIBs greatly diminishes the payoff for crypto-mining. Ethereum, the best-suited coin for GPUs, will fork into version 2.0 very soon, making GPUs obsolete. A person would be very foolish to invest in a high-end, power-consuming AIB for crypto-mining today," JPR writes.

The report predicts GPU shipments will grow 21 percent across the next five years, while semiconductor vendors are guiding up for the next quarter. Let's hope availability starts improving soon.