Why it matters: No stranger to breaking records, Facebook has just achieved another: the social media giant's market cap has exceeded $1 trillion for the first time, reaching the milestone faster than any other company in history.

Yesterday's decision by US District Judge James Boasberg to grant Facebook's request to dismiss two major antitrust lawsuits boosted the company's shares by over 4%, increasing its market cap to more than $1 trillion for the first time.

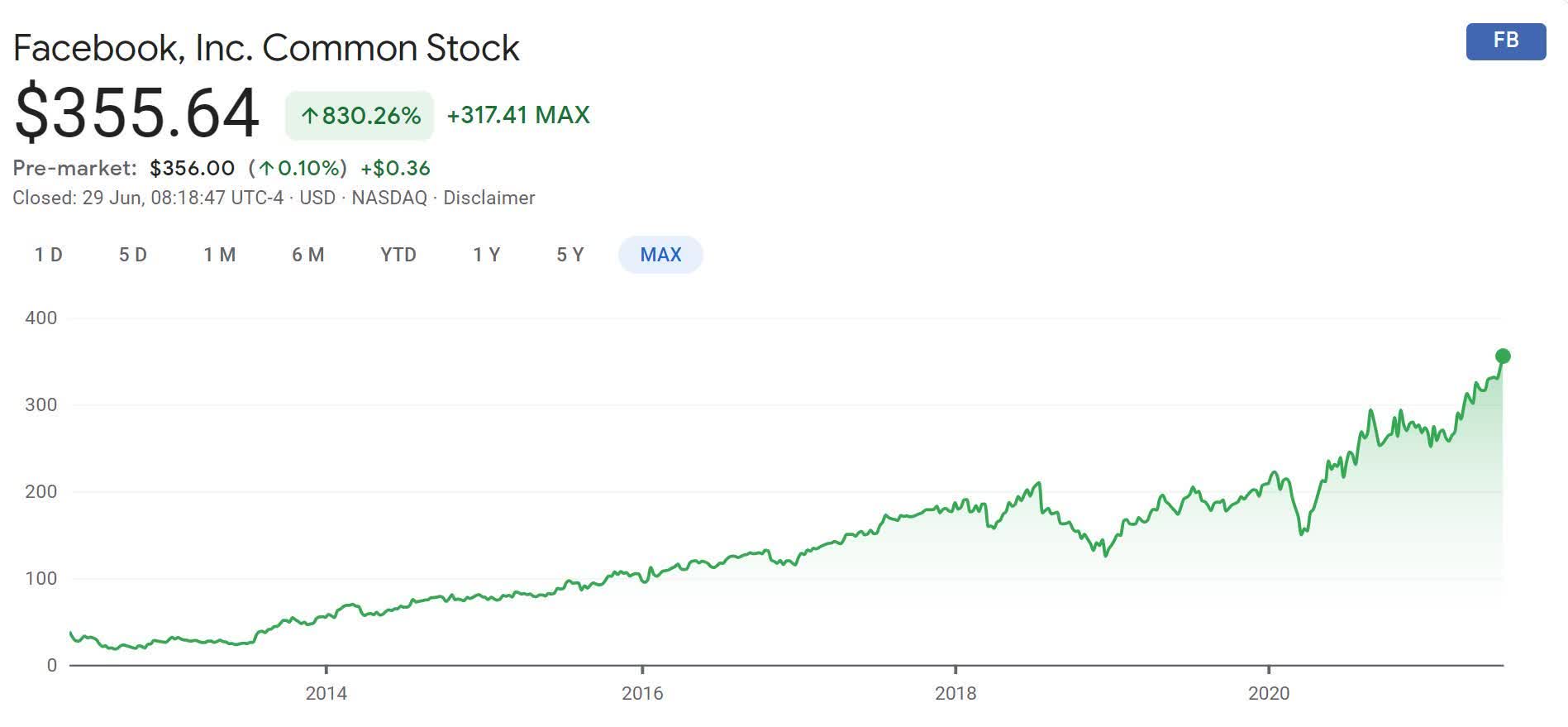

In crossing the $1 trillion mark, Facebook joins fellow tech giants Apple, Microsoft, Amazon and Alphabet in a very exclusive club. It also has the distinction of getting there faster than any other firm, taking just 17 years from when Mark Zuckerberg co-founded the company at Harvard in 2004; that's counting Google's 1998 starting date, rather than Alphabet's creation in 2015. At the time of Facebook's IPO in May 2012, it was worth $104 billion.

Facebook still has some way to go before reaching the $2 trillion+ valuations of Microsoft and Apple. The former last week became only the second US company to pass that figure. It took Microsoft 33 years from its IPO to reach its first $1 trillion valuation in 2019, but hitting $2 trillion took around just two years.

As with virtually every tech company, the pandemic has boosted Facebook's shares, up 30% this year, as the public increase their reliance on its suite of apps for communicating, socializing, and working remotely.

In the antitrust complaint against Facebook brought by the Federal Trade Commission (FTC) and 48 state attorneys general, the FTC requested Facebook unwind prior acquisitions, including Instagram and WhatsApp, and restrict any future anticompetitive behavior.

The Judge ruled that the government failed to provide enough evidence that Facebook was a monopoly. As noted by Bloomberg, it's likely that the FTC will refile an amended case within 30 days, meaning that the $1 trillion valuation could be short-lived.