In brief: The shortage of everything from raw materials to chips and other essential components is having a ripple effect on the electronics and auto industries, but that's only the beginning. Suppliers in North America, Asia, and Europe are now facing an even bigger problem---the rising difficulty and cost of finding skilled workers to keep the industry machine going at a time when demand is higher than it's been in years.

The ongoing chip shortage has put a lot of strain on the supply chains of many tech companies. Still, there's an even bigger problem looming over electronics manufacturers, some of which have gone on a hiring spree to meet high consumer demand in the holiday quarter. Almost 80 percent of them now say that it's become harder to find qualified workers for their factories.

According to the IPC---who represents chipmakers, contract manufacturers like Foxconn, and other suppliers---the cost of finding skilled workers has grown considerably over the past year. This trend is expected to continue well into 2022. The timing is unfortunate, as demand for everything with a chip inside is more robust than it's been in years.

The organization surveyed hundreds of suppliers from Asia, North America, and Europe to get a clearer picture of the overall electronics manufacturing value chain. It looks like two-thirds of American companies are having trouble acquiring a skilled workforce, and the situation is similar for European suppliers. Meanwhile, only a third of Asian suppliers have this problem, primarily thanks to lower labor costs and more relaxed worker safety regulations.

Solving this problem isn't easy, but almost half of the organizations surveyed said they were retraining existing employees and offering more attractive compensation for in-demand positions. That said, new Covid-19 outbreaks have led to travel restrictions, especially in Asia, making it more challenging for companies to bring in more factory workers and engineering talent.

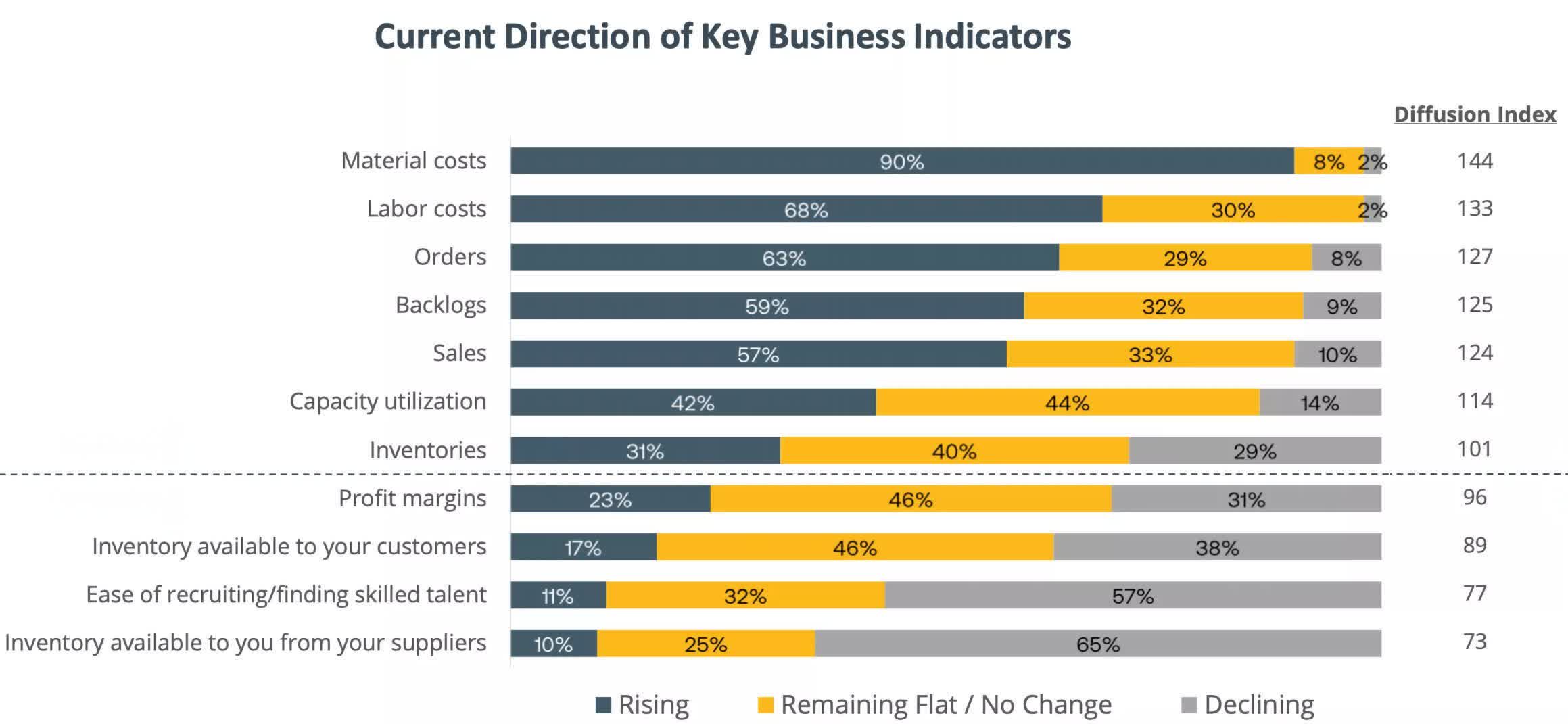

Interestingly, 90 percent of all companies that participated in the survey said the cost of materials and components had risen considerably over the past year, cutting deep into profit margins. This fluctuation is in line with a report this month that rare earth metal prices have exploded in the past twelve months, which could lead to increased retail prices for all electronics as soon as next year.

Automakers are among the hardest hit among all customers for these suppliers. According to AlixPartners, the auto industry will likely lose a whopping $210 billion in revenue this year, almost twice as much as previous estimates released in May. Many automakers have had to scale back production amid the chip shortage, which is expected to cause a loss of 7.7 million car units from this year's manufacturing target.

Masthead credit: ASML