In context: ASML may not be a household name like Intel, Samsung, or even TSMC. However, the Dutch company is the world's only supplier of advanced extreme ultraviolet (EUV) equipment that allows tech giants to pack increasing numbers of transistors onto tiny chips that power a wide variety of devices. Current generation EUV machines are already marvels of engineering that shrink the wavelength of light used to etch ever-smaller features on microchips, but ASML says it's readying a newer version that will give the semiconductor industry a new lease on life for the next decade.

Moore's Law has been on life support for a while now, but it's not dead yet. ASML says its latest EUV lithography machine will extend the validity of the idea that chipmakers can cram an increasingly higher number of transistors on a silicon substrate for the next 10 years or so.

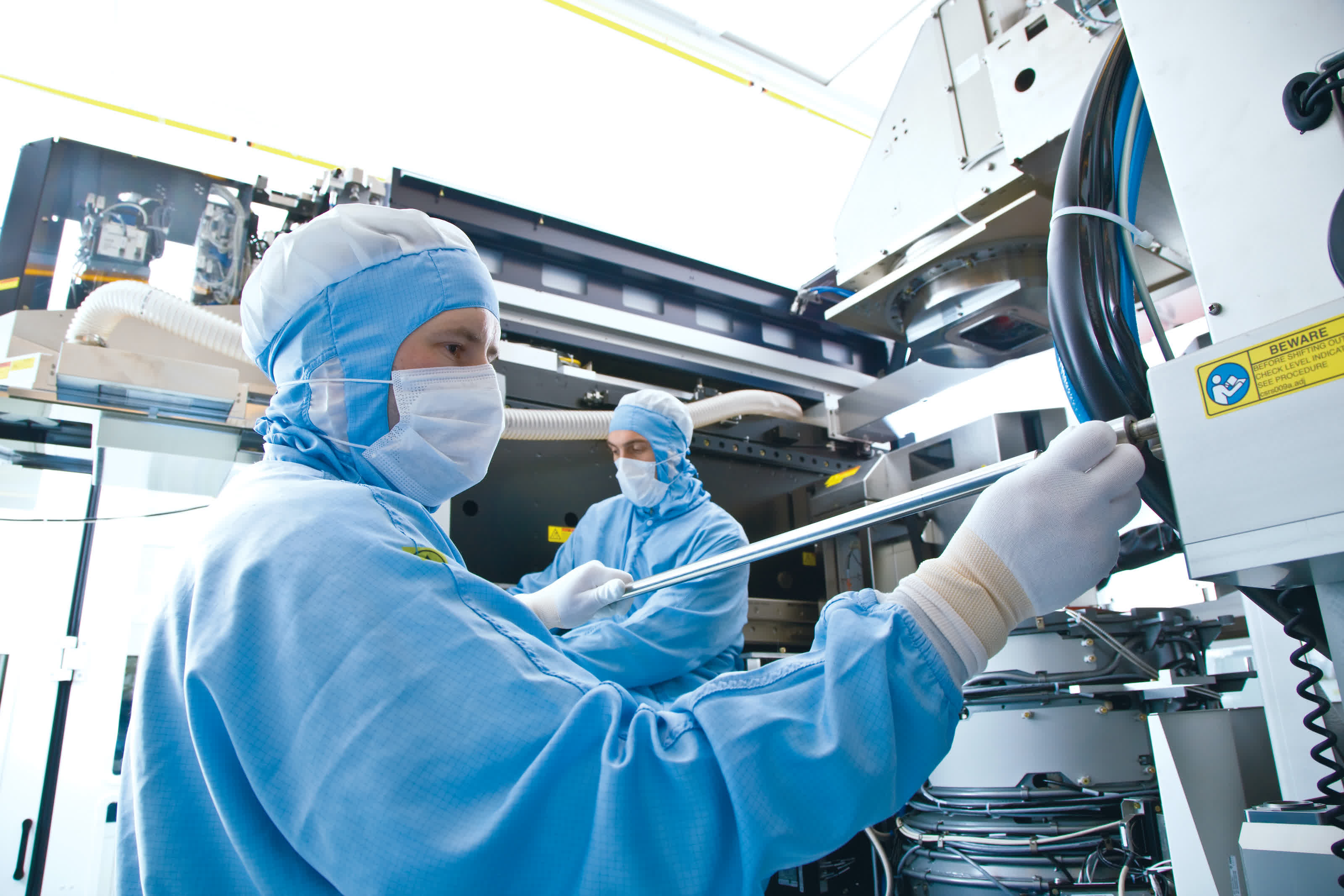

As of writing, the Dutch company is the world's sole supplier of EUV equipment, which is used to etch tiny nanoscopic features into chips using ultraviolet light. The company's first machines started humming in 2017, and are a crucial part of the chipmaking ecosystem that has been churning out ever more advanced silicon for a variety of devices.

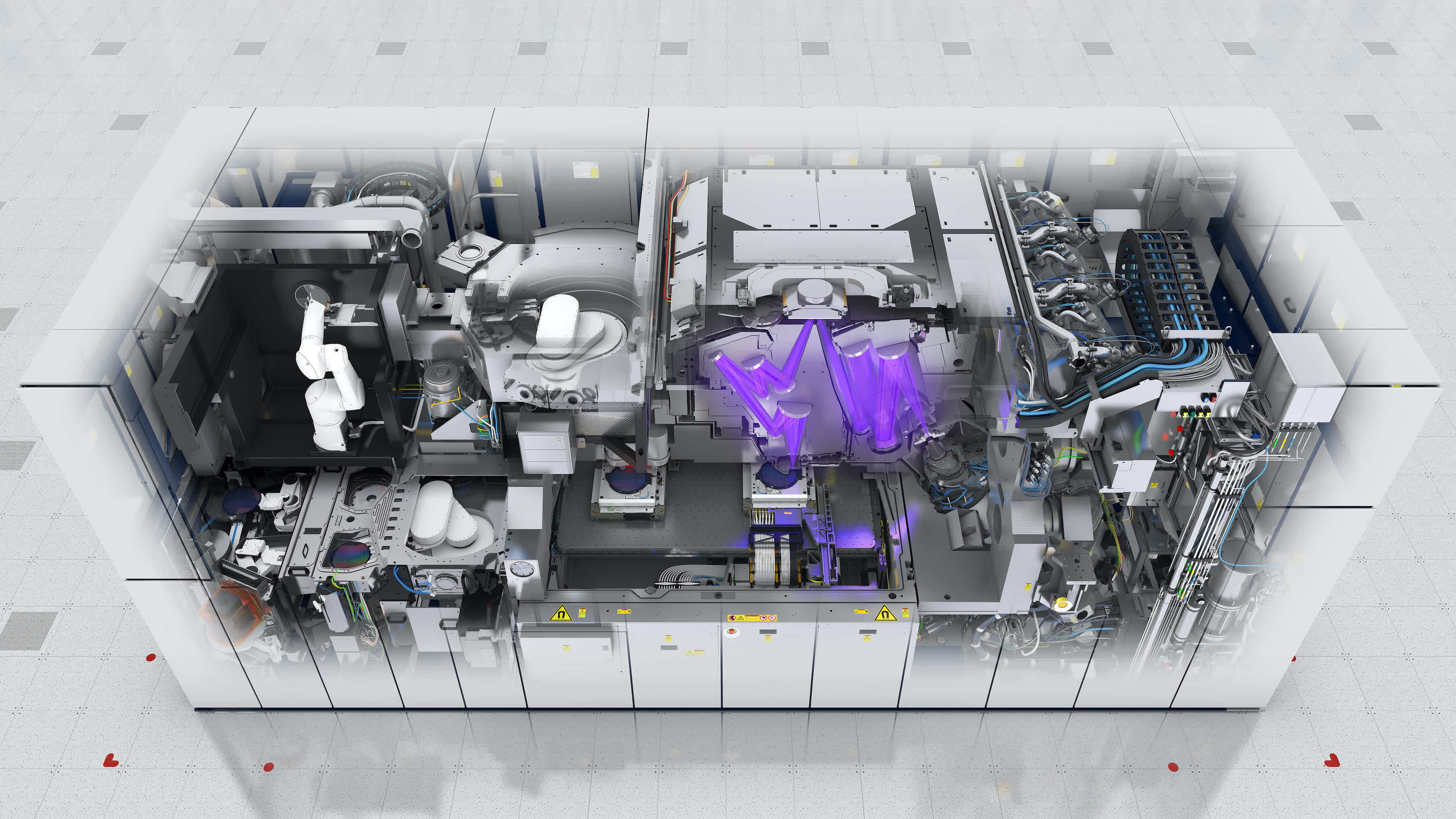

The company's EUV machines are just as expensive as they are advanced. Each one costs $150 million and contains over 100,000 parts and two kilometers of cabling, all of which are a logistical nightmare to source and assemble. That's why you can count the companies that can afford them using just the fingers on one hand. Most of the machines, however, end up at manufacturing plants that are owned by Intel, Samsung, and TSMC.

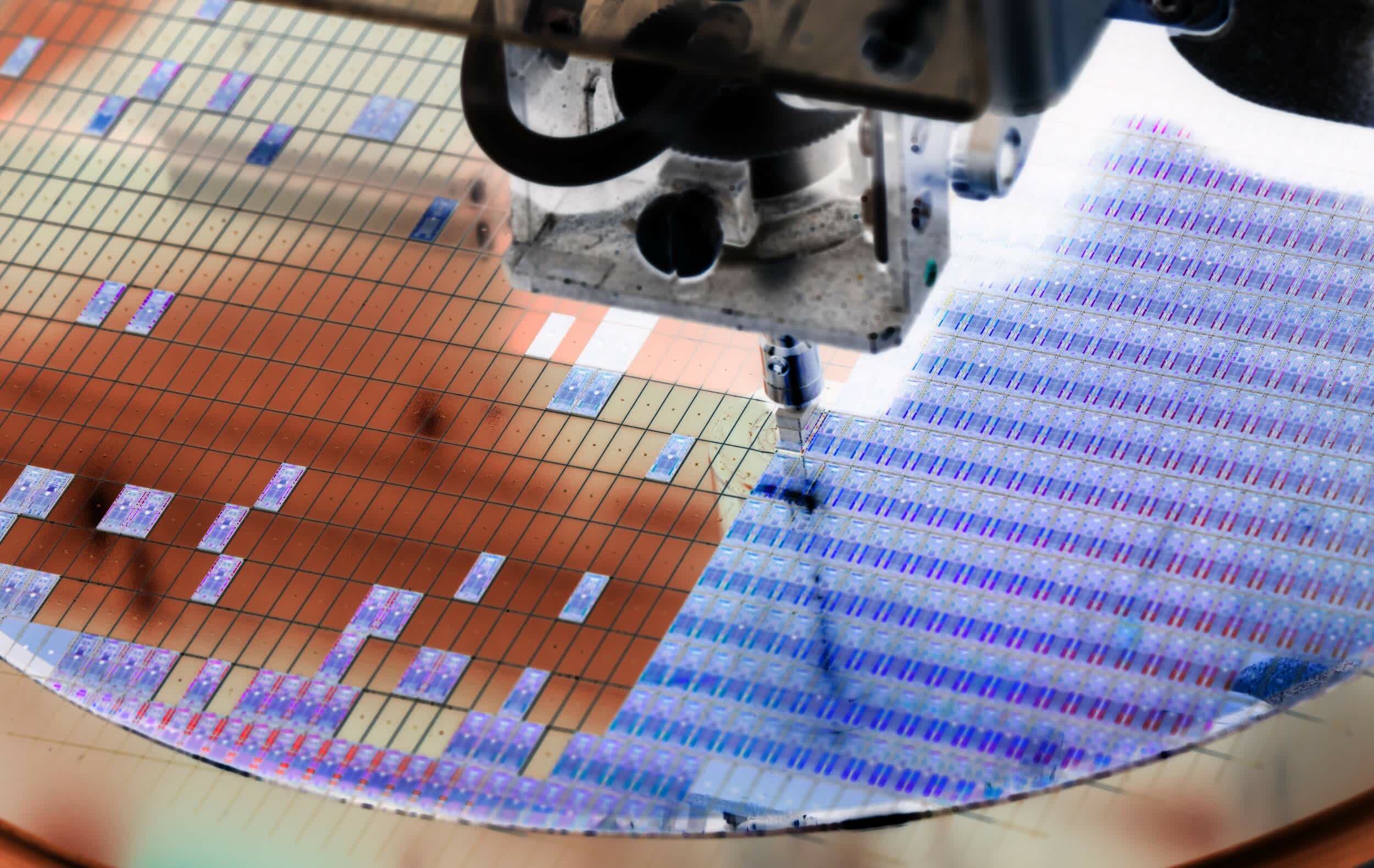

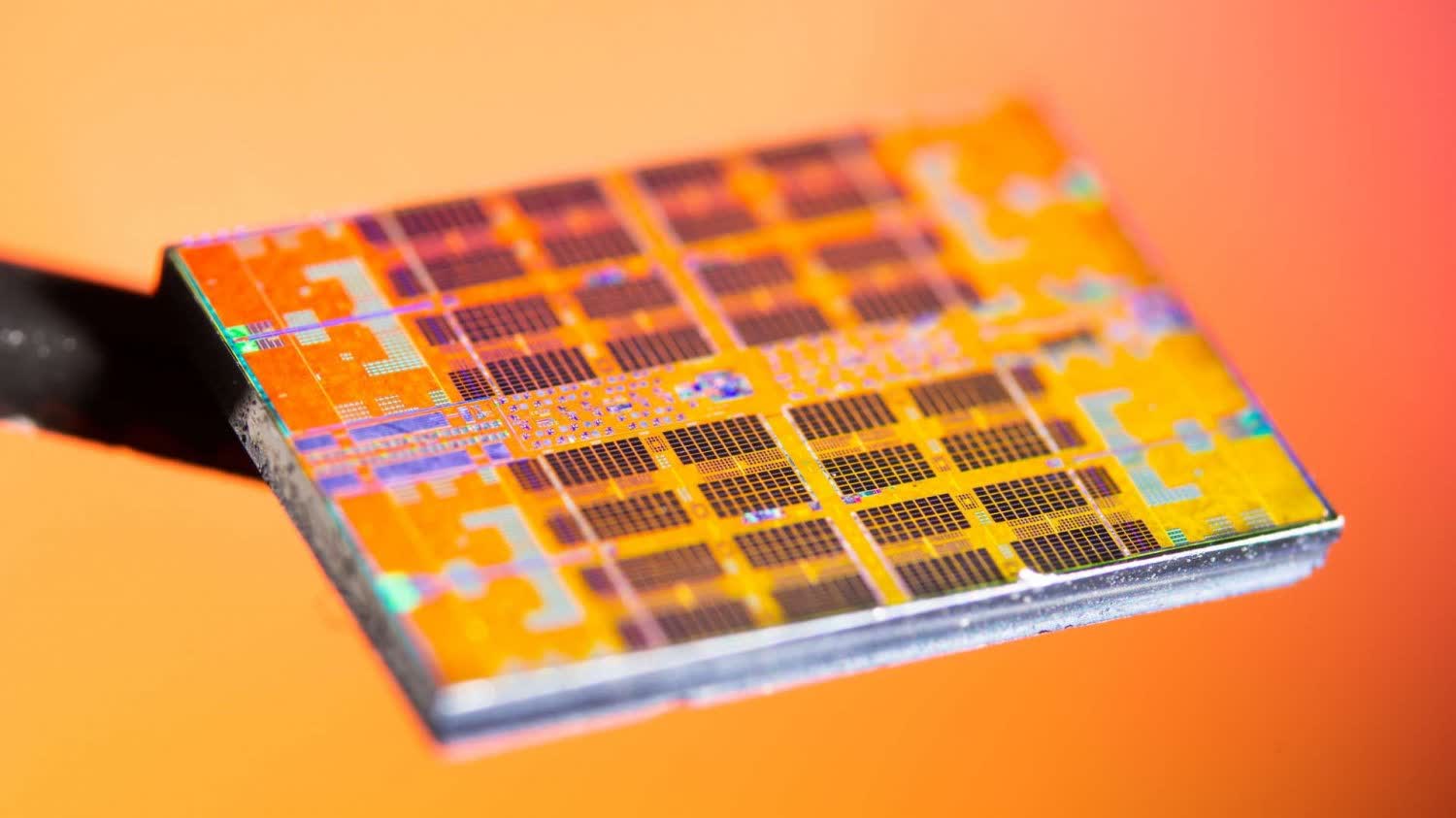

Starting in 2023, ASML plans to deliver the first batch of next-generation EUV equipment that will take the EUV numerical aperture (NA) higher than current machines are capable of, from 0.33 NA to 0.55 NA. This will enable chipmakers to develop process nodes well beyond the current expected threshold of 2 nm, and should also yield some cost savings when using a single-expose EUV process for advanced wafer layers.

The first of these new machines will be a prototype that will be tested throughout 2022. As for which chipmaker will be the first to make chips, that would be Intel, who wants to use them in mass production as early as 2023. The tech giant has recently embarked on a multi-year process to regain leadership in process and packaging technologies, and high-NA EUV tools are a key part of this plan. In fact, if Intel's IDM 2.0 initiative has any chance of being successful, it needs all the help it can get from ASML.

TSMC is also interested in acquiring as much of this next-generation lithography equipment as possible. The Taiwanese company currently accounts for half of the industry's EUV equipment installation base and wafer production, and has plans to expand capacity with two state-of-the-art 2 nm GigaFabs. Ironically, TSMC used to be a EUV non-believer, but today it is ASML's biggest customer thanks to Apple's insistence that EUV is the key to smaller, more powerful, and more energy-efficient chips.

Following the EUV path has allowed TSMC to accelerate past Intel and Samsung, but Intel could turn the tides by becoming an early adopter of high-NA EUV tech. At the same time, Samsung is also looking to get in on the action with a $205 billion commitment that is largely directed at conquering semiconductors. It, too, has benefited greatly over the years from its $306 million investment it made into ASML more than a decade ago, and has expressed interest in getting a stable supply of advanced EUV equipment from the latter company.

While Intel, Samsung, and TSMC seem to be well positioned to benefit from ASML's innovations, there are companies that have significant barriers in doing so, both financial and political. Most notably, Chinese companies like Semiconductor Manufacturing International Corp. (SMIC) have been scrambling to catch up with the rest of the semiconductor industry, but they're also on the US Entity List.

This means they're effectively barred from purchasing advanced lithography equipment, as the US government has also ensured that ASML won't sell any EUV machines to Chinese companies, at least for now. ASML CEO Peter Wennink doesn't think this strategy will ultimately bode well for the US economy, as he believes China has both the drive and the means to make progress on its own while non-Chinese economies will suffer a loss of jobs and income. And you only need to look at YMTC's recent 128-layer 3D NAND success to understand that he's right.

Circling back to ASML, the company predicts a sales boom that will propel its annual revenue to new heights by 2025. Previously, the forecasted annual revenue was in the $17 to $28 billion range, but now the company is confident it will be in the $28 to $35 billion range, with gross margins between 54 percent and 56 percent. The new figures hinge on the current surge in demand for everything with a chip in it, which has all the world's foundries and component suppliers firing up on all cylinders.