In brief: Intel has big plans for the future, but they don't involve a chip plant in the UK. Post-Brexit, the company no longer considers the country a good location for its expansion under the IDM 2.0 strategy, so it is currently evaluating several proposals from 10 other European countries.

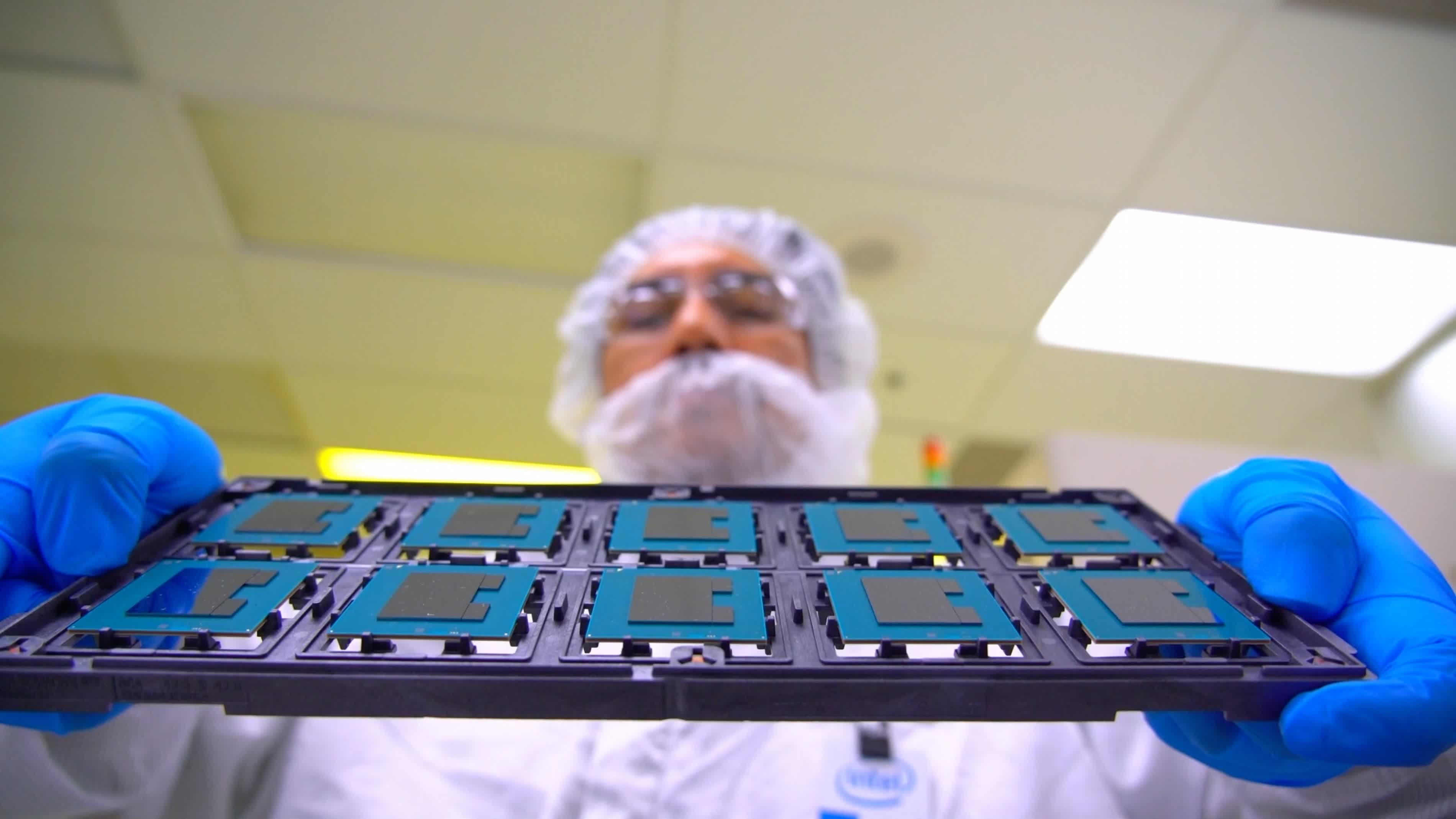

Last month, Intel broke ground on two advanced chip fabs in Arizona. These are key to the company's renewed IDM 2.0 strategy that will see the new Intel Foundry Services division take on contract manufacturing for other companies for the first time in history.

Intel is also looking to build another pair of chip manufacturing plants in Europe, but the company is still in talks with several officials in the region to determine the best location for the new fabs, as well as secure much-needed subsidies for the project.

During an interview with the BBC, CEO Pat Gelsinger said the company had been considering the UK as a potential location for a chip fab, but that is no longer an option due to Brexit. After the UK made its decision to leave the European Union, Intel has heard no less than 70 proposals for sites across 10 other countries in Europe, some of which looked more attractive to Intel in the present context.

Gelsinger says he's hopeful the company will be able to reach an agreement on the site for the two new fabs by the end of this year. Discussions with EU officials are also progressing well, and Intel is hoping to tap into the bloc's Recovery and Resilience Fund for subsidies. As for Intel, it plans to invest as much as $95 billion into the ambitious project.

Also read: ASML's next-gen EUV machine will give Moore's Law a new lease of life

In the meantime, the industry as a whole will have to contend with a shortage of chips that has automakers scrambling to secure contracts for mature process nodes. As of writing, more than 85 percent of the world's semiconductor manufacturing capacity is concentrated in a handful of Asian countries, while the US and Europe account for 12 percent and 2.8 percent, respectively.

Gelsinger is one of the proponents of a "globally balanced supply chain," but building chip factories is a multi-year effort that costs between $10 billion and $20 billion per facility. Even though TSMC, Samsung, and GlobalFoundries are also pouring billions into their own expansion plans, all of it will take years to come to fruition.

As for the ongoing chip shortage, Gelsinger believes the situation won't fully stabilize until 2023.