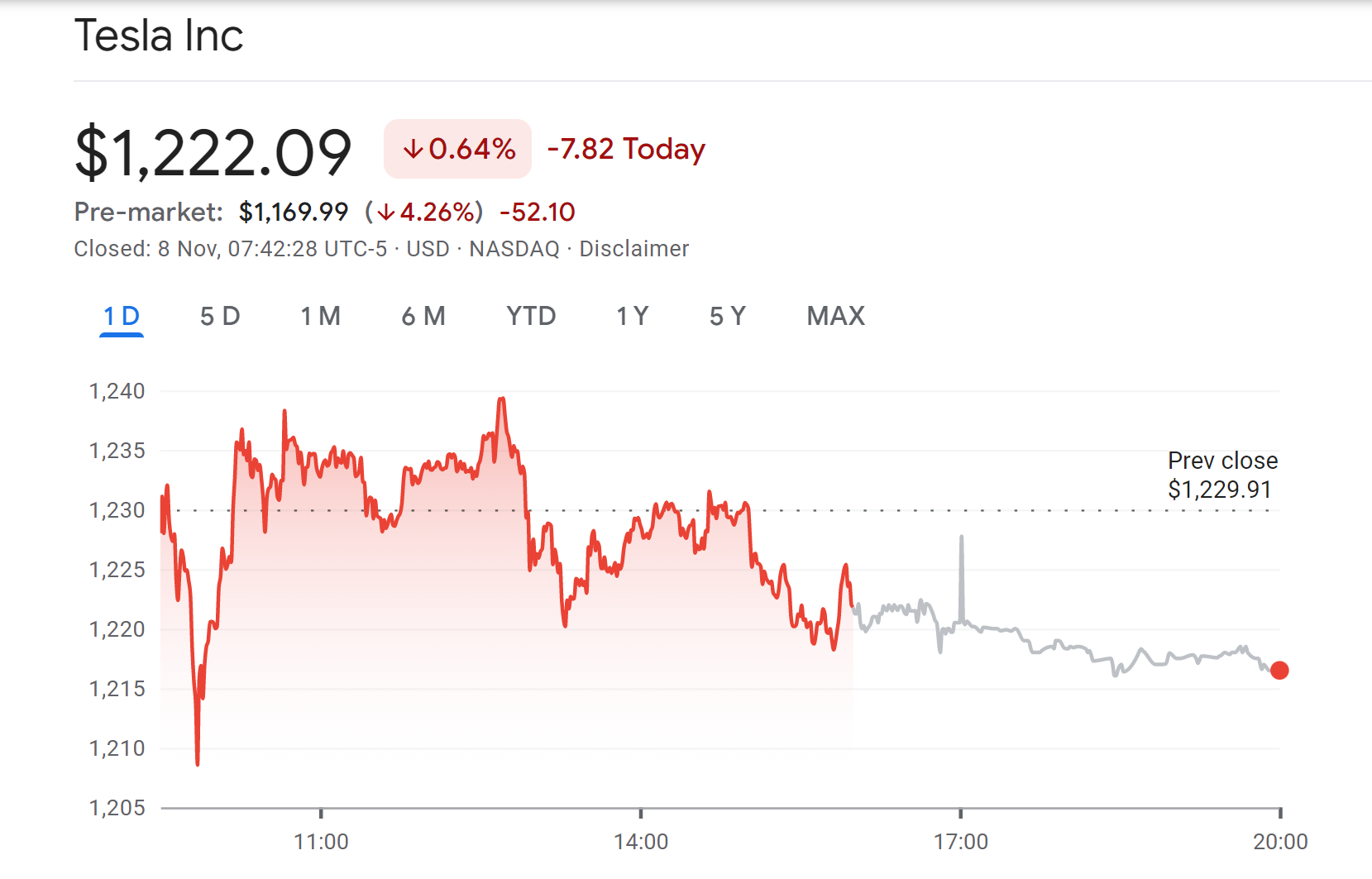

In context: Tesla shares fell 9% this morning, and it's partly because of Twitter. Well, Twitter and Elon Musk. The EV company's CEO tweeted on Saturday that he would sell 10% of his stock if the platform's users approved the move in a poll. After more than 3.5 million votes, 57.9% of participants chose in favor of the sale.

Musk posted his tweet following the recent legislative proposal that would see unrealized gains taxed. A report earlier this year showed the billionaire avoided paying any federal income tax in 2018 while handing over just $68,000 in 2015 and $65,000 in 2017.

Most billionaires are able to pay such little tax because the government only taxes what it defines as income, so when the value of the stock they hold increases, their wealth isn't taxed. They can then borrow against the stock to pay living expenses.

Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock.

--- Lorde Edge (@elonmusk) November 6, 2021

Do you support this?

Musk later tweeted that he only receives payment from his companies in stock and doesn't take a cash salary or bonus, so "the only way for me to pay taxes personally is to sell stock." The BBC notes that he has made billions of dollars through a compensation package, which gives him power to exercise large amounts of stock options when Tesla meets performance targets and its shares hit certain prices.

Musk owed about 170.5 million Tesla shares as of 30 June. Selling 10% of those would amount to around $21 billion, according to Reuters' calculations.

Musk has been pretty quiet regarding the poll's outcome, other than to say that he "will abide by the results of this poll, whichever way it goes."

While Musk appears to have been putting the decision of whether to sell his Tesla stock into the hands of his 62.7 million Twitter followers, he may have sold his holdings regardless. CNBC notes that Musk faces a billion-dollar tax bill in the coming months on the 22.8 million shares he was awarded as stock options in 2012. To exercise the options, Musk must pay tax on what he's made on those shares at their current price, which is around $28 billion. With a combined state and federal tax rate of 54.1%, that would amount to $15 billion. Musk previously said that he would be selling some of his options in the fourth quarter of this year because they were set to expire.