What just happened? AMD's fortunes have turned around since the launch of its first Zen architecture in 2017, though few would have expected it to hit this milestone in such a short amount of time: AMD now has a larger market cap than rival Intel for the first time ever.

The sudden boost in AMD's market cap came from its $49 billion all-stock takeover of Xilinx on Monday, 15 months after the move was announced. The change in the companies' stock prices added 40% extra to the deal; it was worth $35 billion back when first AMD revealed its intentions.

The acquisition is one of the largest in tech history, sitting behind Dell paying $67 billion for EMC in 2015 and Microsoft's recent purchase of Activision Blizzard for $68.7 billion.

The deal meant that for every share of Xilinx a shareholder held, they received 1.7234 new shares of AMD, converting 248.38 million of the former into 428 million of the latter. As a result, AMD's overall share count increased to 1.628 million, writes Tom's Hardware.

The increase in the number of shares saw AMD's market cap jump to $197.75 billion, pushing it past Intel's $197.24 billion by $51 million.

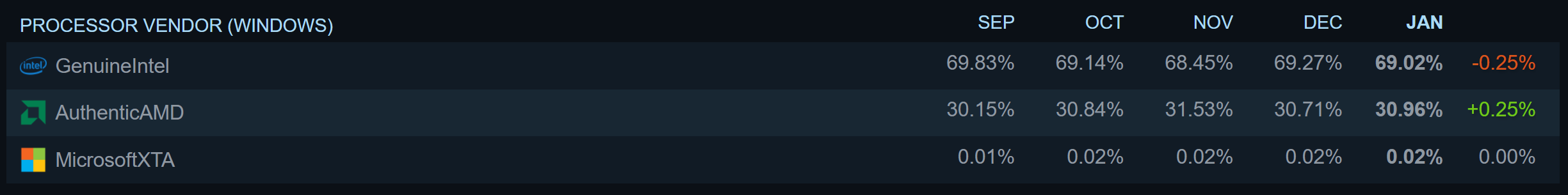

It's been a good month for AMD. In addition to passing Intel's market cap, team red hit a record 25.6% share of the overall x86 market. It also bounced back in January's Steam survey after the number of participants using its CPUs fell in December. Moreover, its stock price is $121.47, more than double Intel's $48.44.

Intel still boasts three-quarters of the x86 market share, of course, and its CPUs are found in 70% of Steam survey participants' PCs. It also brings in more revenue and profit than AMD, not to mention it has its own fabs. But the Ryzen maker keeps chipping away at the blue team's lead, and we can expect things to get even more interesting when the all-new Zen 4 arrives later this year.