What just happened? GameStop is making layoffs across the company and has fired its Chief Financial Operator, Mike Recupero, as the video game retailer focuses on "digital asset and web3 gaming verticals." The move comes in the middle of a crypto winter that has seen the price of digital currencies and non-fungible tokens plummet.

An internal memo from GameStop CEO Matt Furlong that was leaked on Reddit reads: "Change will be a constant as we evolve our commerce business and launch new products through our blockchain group."

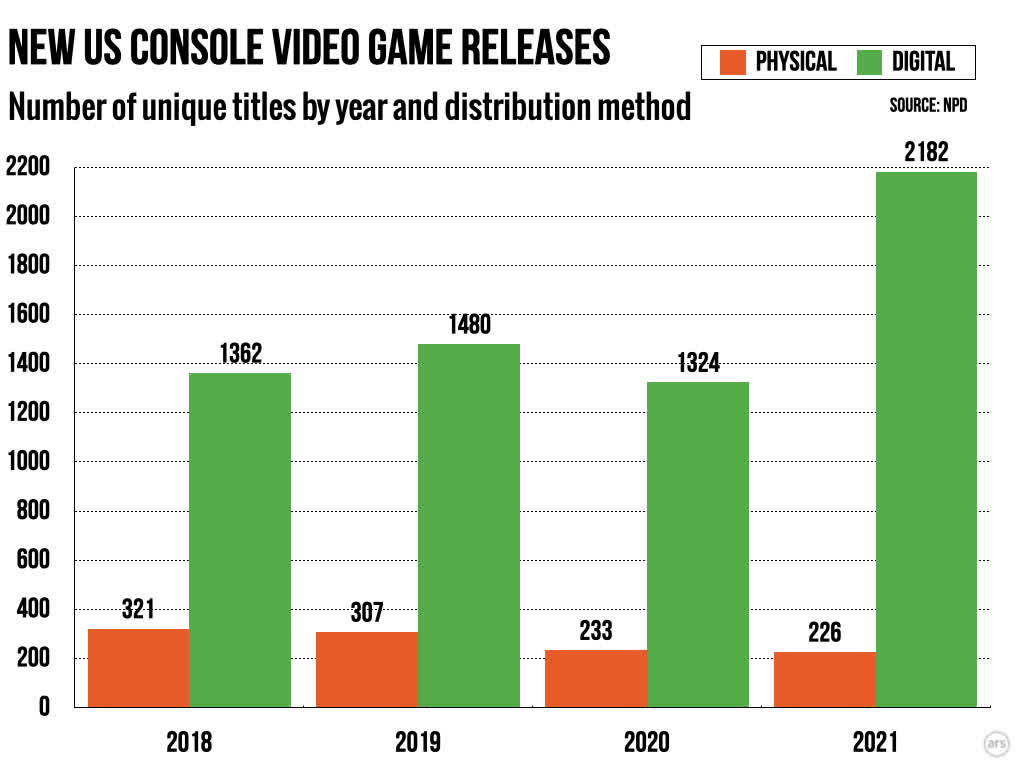

The last few years have seen consoles going the way of the PC as physical games fall behind their digitally downloadable alternatives. Ars Technica reports that there were 226 new games available on discs or cartridges last year, compared to almost 2,200 digital titles. The rising popularity of game subscription services and streaming is also impacting physical sales.

The changing landscape led to GameStop getting into the world of crypto and NFTs earlier this year, launching a digital wallet for both assets in May. Despite crypto prices crashing recently, Furlong believes GameStop is on the right path. "These changes will enable us to operate in a profitable manner as we execute against our strategy of pursuing sales growth in our commerce business and launching new products that empower customers within the digital asset and web3 gaming verticals," he wrote.

Furlong added that GameStop had invested heavily in personnel (over 600 corporate hires), technology, inventory, and supply chain infrastructure over the past 18 months. "This means eliminating excess costs and operating with an intense owner's mentality. Everyone in the organization must become even more hands-on and embrace a heightened level of accountability for results."

One Reddit post claims that around 20% of staff are being let go, most of which come from hires made within the last six months. It adds that nobody from the NFT team has been fired.

The layoffs include employees of online magazine Game Informer, which GameStop acquired in 2000.

GameStop's financial results from the previous quarter showed sales increasing very slightly, but net losses doubled to more than $158 million.

GameStop hit the headlines in 2021 after its share price jumped 680%, thanks to the GameStonk phenomenon. It saw Redditors buy heavily shorted stocks in the company, forcing hedge funds and investors to buy back stock to mitigate their losses.

Bloomberg reports that shares were down 5% in extended trading following news of the layoffs.

h/t: PC Gamer