The big picture: As the crypto crash continues to leave Bitcoin prices depressed compared to their position a year ago, knock-on effects are still playing out in various areas. One of those is the production cost, and miners' efforts to control it may be a double-edged sword for the crypto market.

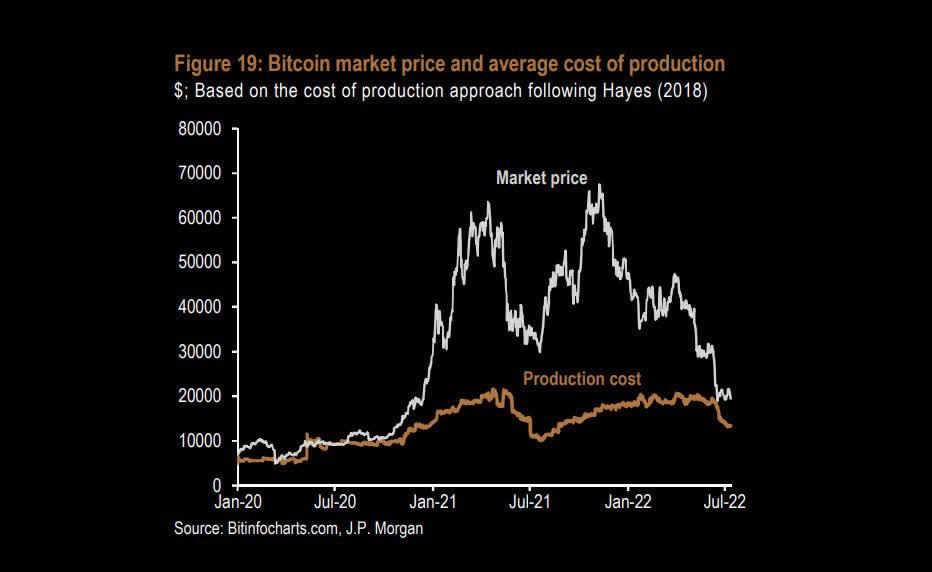

JPMorgan Chase & Co. reports that the cost of mining Bitcoin has fallen to around $13,000 from $24,000 since early June. Bloomberg notes that the drop is likely an effect of the crypto winter, but it's unclear whether this could help or hinder any recovery of the cryptocurrency's price.

It's easy to pin the decline on a miner exodus after Bitcoin's price crashed from its high last November, which could be lowering the amount of electricity and processing power needed for mining. Summer heatwaves might also encourage some mining pauses. However, JPMorgan strategists led by Nikolaos Panigirtzoglou claim it's actually due to miners protecting profitability through more efficient rigs.

On the one hand, lowering mining costs to make Bitcoin more profitable could stabilize the market. On the other hand, some see that production cost as the floor for Bitcoin's price during downturns. Lowering that floor might make it possible for the crypto winter to get even worse.

Bitcoin peaked at almost $70,000 last November before tanking this spring. The downturn has sent shockwaves through various entities like crypto companies, El Salvador's government, North Korea's weapons program, and ransomware gangs.