The big picture: A new research report shows that desktop CPUs haven't escaped broader economic trends like inflation and falling product demand. The tech industry's Q2 numbers are down all over, and yet AMD is somehow coming off an excellent quarter, making gains on chief rival Intel.

Mercury Research reports (via Tom's Hardware) that last quarter's desktop CPU shipments saw their biggest year-on-year decline since the group started keeping records in 1994. One researcher suspects this is the largest decline since 1984. The report suggests reduced OEM inventory and falling demand are the primary driving factors.

As the pandemic economy appears to be ending, that declining demand has manifested in bad reports in various areas. Intel lost half a billion dollars amid a 22 percent year-over-year revenue decline. Nvidia's gaming revenue dropped by one-third. Phone shipments fell for the fourth consecutive quarter, Chromebook shipments decreased 50 percent year-over-year, and growth for tablets flattened. One of the only companies that did well was AMD.

Earlier this month, AMD reported a 70 percent year-over-year increase in revenue that briefly made it more valuable than Intel. Mercury's report is also upbeat regarding AMD, showing their market share growing against Intel's in multiple areas.

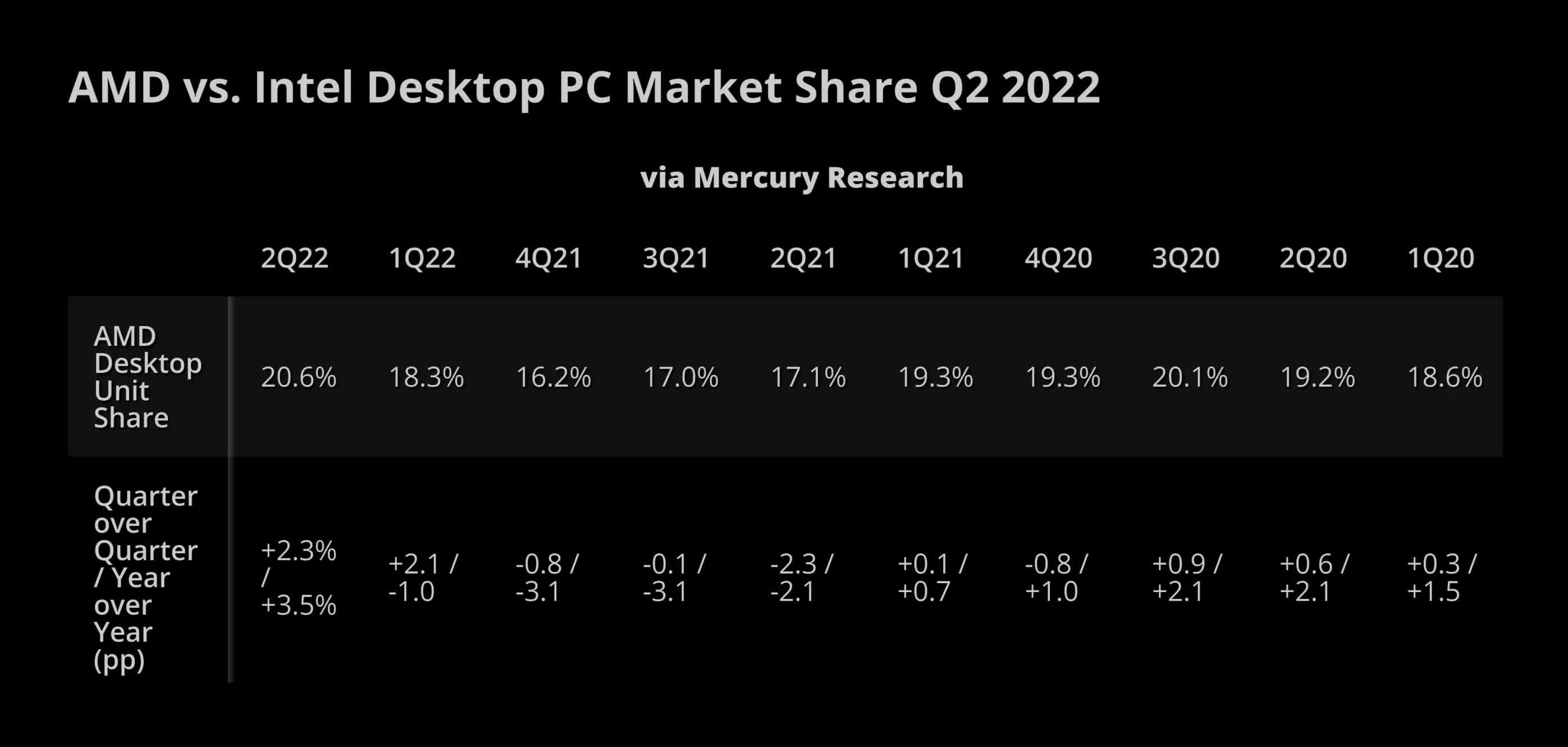

AMD's slice of the desktop PC pie grew 2.3 percent from the previous quarter and 3.5 percent year-over-year. Mercury thinks AMD managed to dodge the forces that hurt Intel here.

In notebook and mobile CPU shipments, falling demand led to year-over-year declines for AMD and Intel, but impacted AMD less. Thus, AMD experienced a 2.3 percent quarterly gain and a 4.8 percent annual gain in market share against Intel.

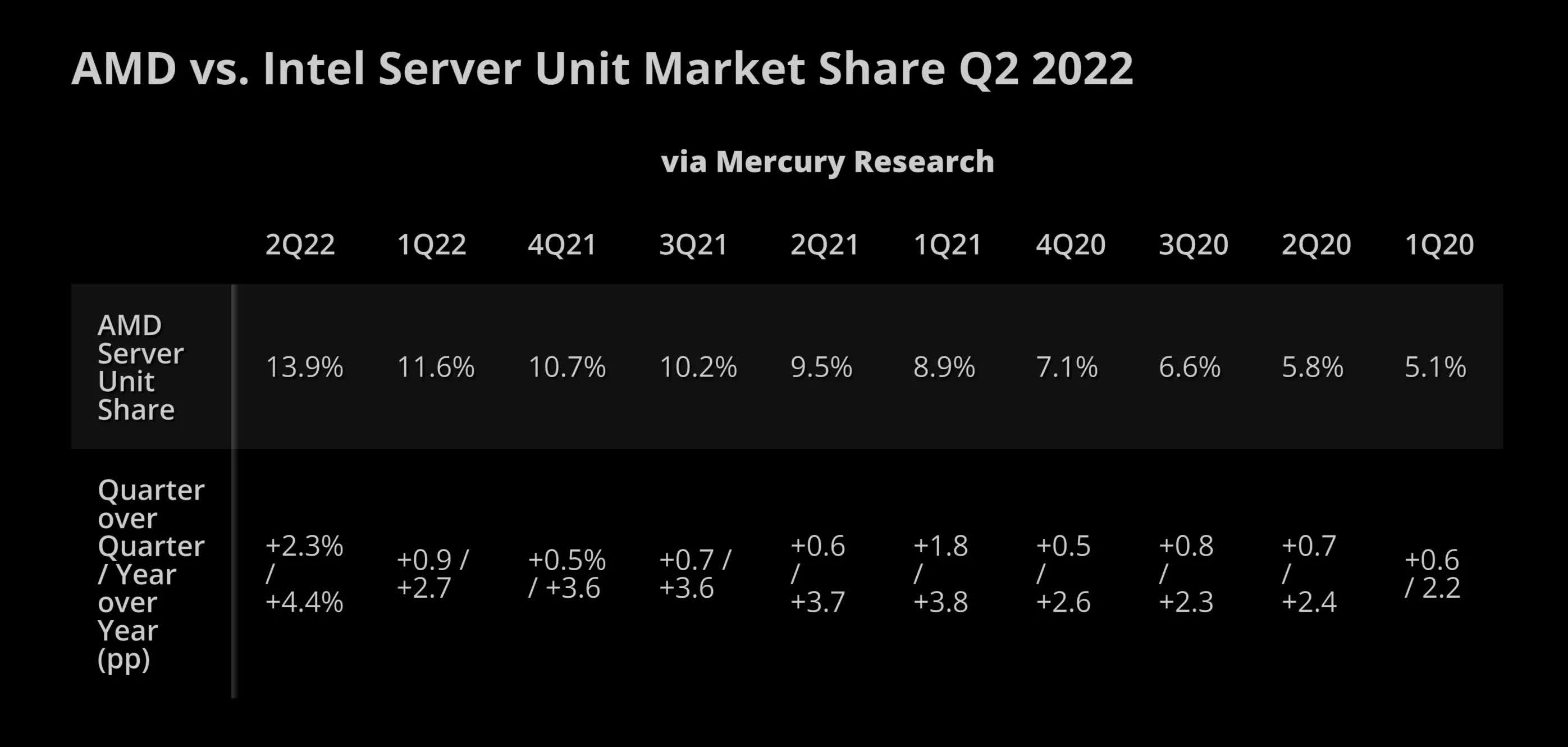

Team Red made similar gains in server unit market share - 2.3 percent quarter-over-quarter and 4.4 percent year-over-year - representing AMD's biggest quarterly gain in servers since Mercury's records in that segment began in 2017.

Similar trends appeared in last month's Steam hardware survey, where AMD's CPU share rose 2.22 percent over the previous month.

Both Intel and AMD plan to launch new desktop CPUs this year. AMD's Ryzen 7000 series will be available next month, while Intel's 13th generation processors could launch in October. AMD also has new Epyc server chips planned for later this year, while Intel delayed its Sapphire Rapids server CPUs, likely into 2023.