In context: Tech companies might be welcoming the passing of the CHIPS Act into law with open arms, but China has once again expressed its displeasure at the $52 billion worth of subsidies partly designed to lessen US reliance on Taiwan's semiconductor industry.

China has long stood opposed to the CHIPS Act, which was signed into law this month, having previously called it "entrenched in the Cold-War and zero-sum game mentality." Now, Yu Xiekang, vice chairman of the China Semiconductor Industry Association, has claimed (via Bloomberg) that the act is designed to give China's rivals a helping hand, with parts of it discriminating against the Asian nation. The US has made similar claims against China, accusing it of boosting domestic firms such as SMIC with subsidies and other policy measures.

There are restrictions within the CHIPS legislation relating to China. Specifically, any of the tech firms that wish to access the $52 billion fund won't be allowed to make chips on a 28nm or smaller process node in the country.

"We resolutely oppose the US' restrictive actions targeting certain countries," Yu told delegates to an industry conference in Nanjing. "It contains essentially discriminatory clauses in market competition and creates an unfair playing field, which goes against the WTO's fair-trade principles."

The US has been increasing its efforts to impede China's chip-making ambitions recently. The Biden administration wants the world's largest supplier of lithography machines used in the chipmaking process, Dutch firm ASML, to stop selling its older deep ultraviolet (DUV) lithography tools to Chinese clients. ASML is already prohibited from selling its most advanced extreme ultraviolet (EUV) lithography equipment to Chinese companies as it cannot obtain an export license from the Dutch government due to pressure from the United States.

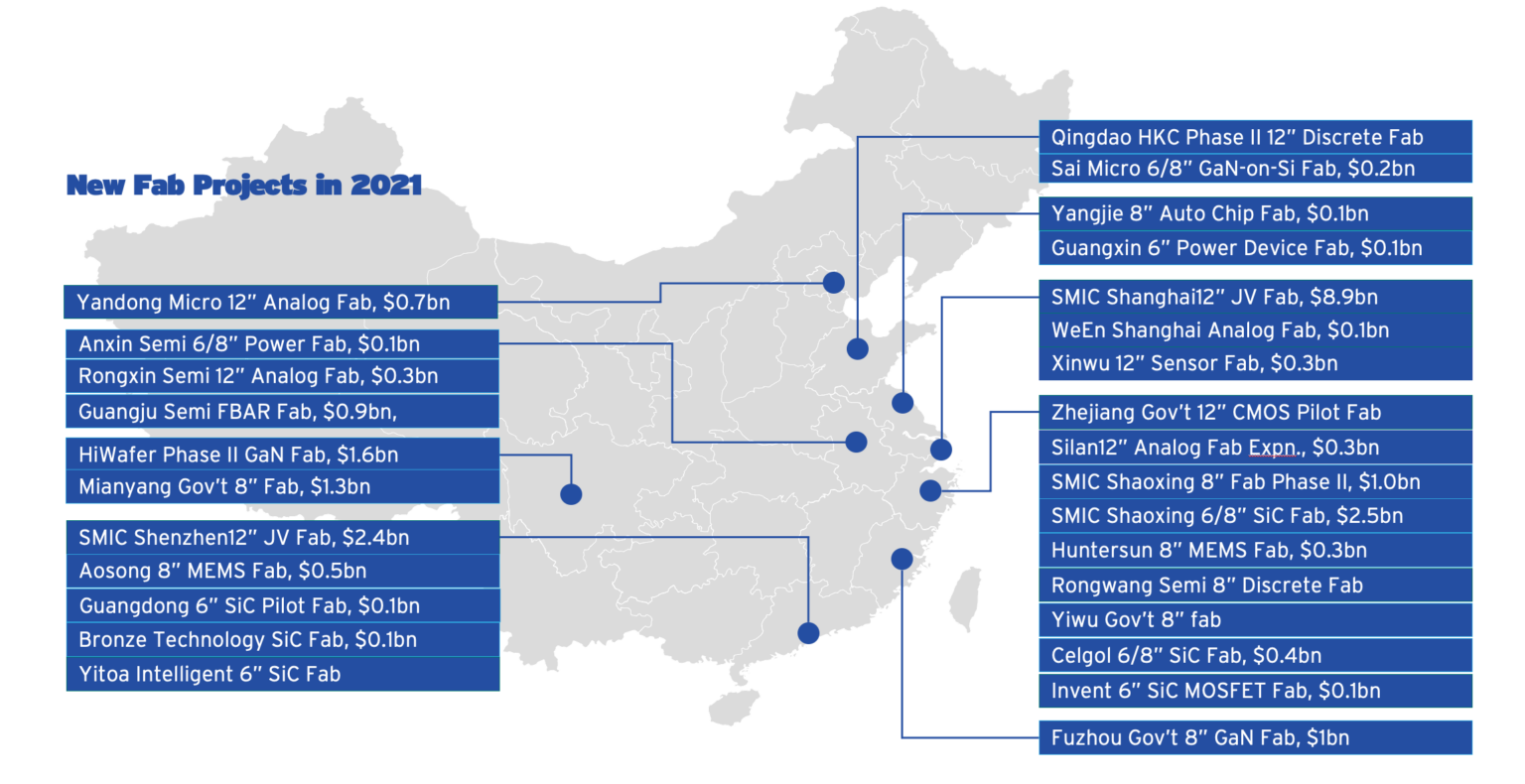

More recently, the US introduced stricter export controls and more restrictions on chipmaking equipment sold to Chinese foundries, a response to advances made by Chinese companies that have seen them start to catch up with industry giants such as Samsung and Micron. China is also building more chip factories than anyone else and considering waving import taxes on materials and equipment used in chip manufacturing until 2030. This is in addition to the subsidies being offered.

Yu said the Chinese government should continue to support its domestic semiconductor industry through policies, thereby easing bottlenecks that stymie technological breakthroughs.