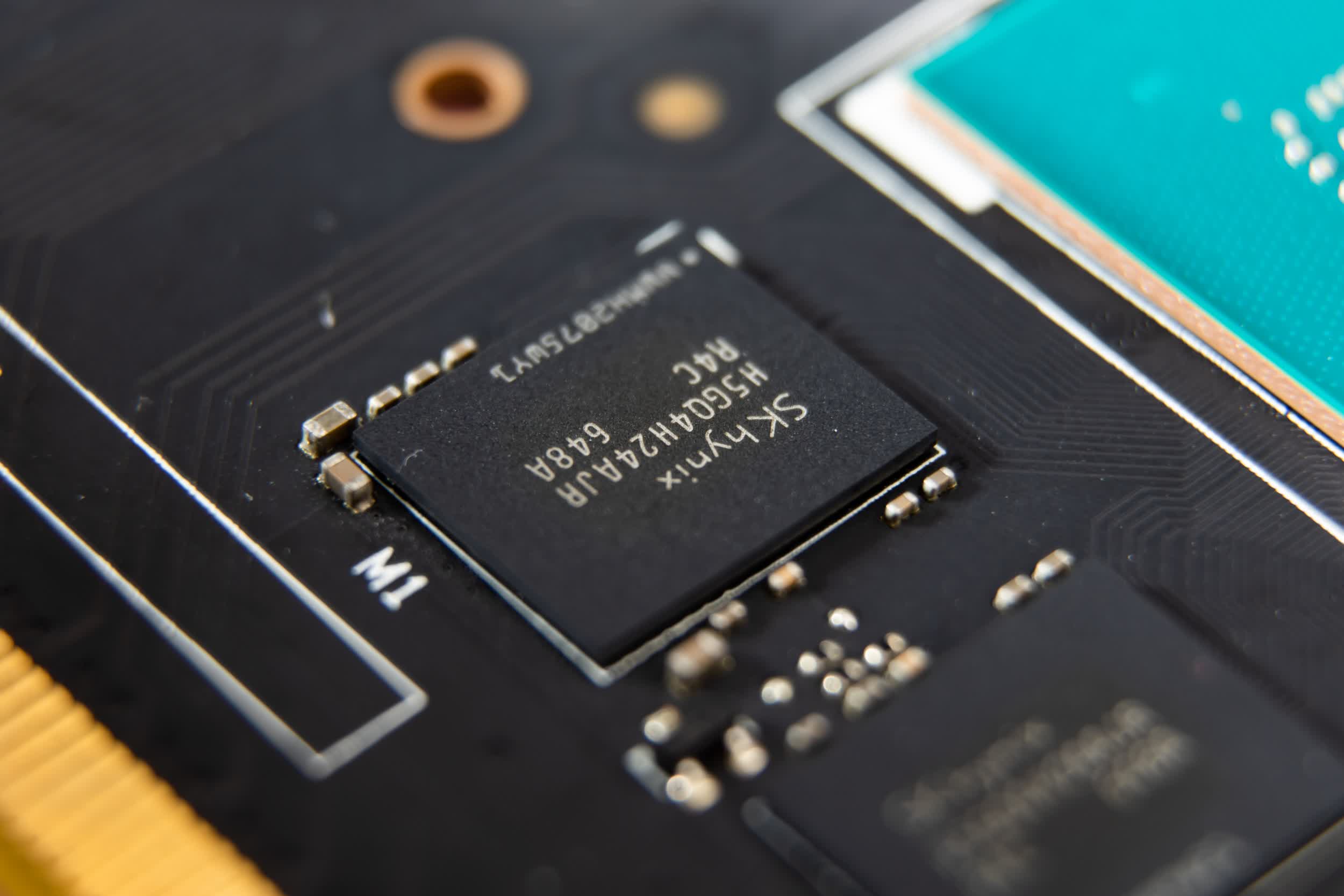

What just happened? Another memory chip giant is suffering the effects of "unprecedented deterioration" in consumer demand and US sanctions against China. SK Hynix said it would slash investment after third-quarter profits fell 60%, warning that the Biden Administration's restrictions could force it to close or sell a major plant in China.

SK Hynix said it would cut 2023 investment by 50% following its Q3 profit crash, the result of high inflation and weak consumer demand.

Exacerbating the company's problems are US restrictions against China's semiconductor industry. SK Hynix said it expects the export controls to hinder any expansion plans for its plant in Wuxi, China, where almost half of all the company's DRAM chips are produced.

Should Washington's restrictions prevent SK Hynix from acquiring the chipmaking tools the factory requires to sustain DRAM production, it would be forced to sell or move the equipment to South Korea. The firm emphasized that this was a worst-case scenario.

The US sanctions introduced earlier this month restrict shipments of American-made electronics or other items that China could use to create chipmaking tools or equipment. They also prevent non-Chinese companies in other countries from using American equipment to service Chinese customers unless granted a license by the US.

TSMC, Samsung, and SK Hynix have all been granted one-year licenses that will allow them to maintain or expand their Chinese factories, but there are fears that the US could introduce more restrictions. SK Hynix said it expects the waiver to be extended but admitted it may still struggle to bring EUV [extreme ultraviolet lithography] equipment into China. "The Wuxi plant will lose its competitiveness without EUV machines, against Samsung and Micron Technology," said Kim Young-woo, head of research at SK Securities.

"If the time comes when it appears difficult to maintain operation of the fab in Wuxi, then we might have to sell off the fab or move the equipment to Korea," said Chief Marketing Officer Kevin Noh. "We are looking into various scenarios, but again, this would amount to a contingency. So this would be an extreme situation."

SK Hynix is one of several memory-chip makers cutting production as the industry struggles with an oversupply problem that has seen prices fall another 20% during the last quarter. It confirmed that the reduction would begin with lower-margin products.

Yesterday brought news that Chinese chipmaker YMTC is asking American employees to leave the company due to US sanctions. TSMC has also spoken out against the restrictions, warning that they will bring "serious challenges" to the industry.