Ouch! Crypto exchange FTX suffered an almost complete implosion falling 85 percent today and a full 90 percent since last week's high of $25.78. The collapse follows allegations that Binance was backing out of a merger deal and the opening of an FTC investigation into FTX mishandling withdrawal requests. The token is now worth less than $3.

Cryptocurrencies continued to tumble on Wednesday as the FTX exchange implodes. Crypto billionaire Sam Bankman-Fried's trading platform experienced what is commonly referred to as a "bank run" after the US Federal Trade Commission announced it had opened an investigation into whether FTX Trading illegally handled customer withdrawals earlier in the week.

A bank run is when a large number of depositors go to take their money out of a bank. It usually happens when people think the institution is about to go insolvent. Since most of a bank's money only exists on paper and is not sitting in the local vault, most depositors looking to withdraw funds walk away empty-handed, further feeding the panic.

In Bankman-Fried's case, the FTC alleges he loaned out investors' FT tokens (FTT) to other crypto lenders like BlockFi and Voyager Digital. He additionally struck several advertising deals with sports teams and athletes to promote FTX.

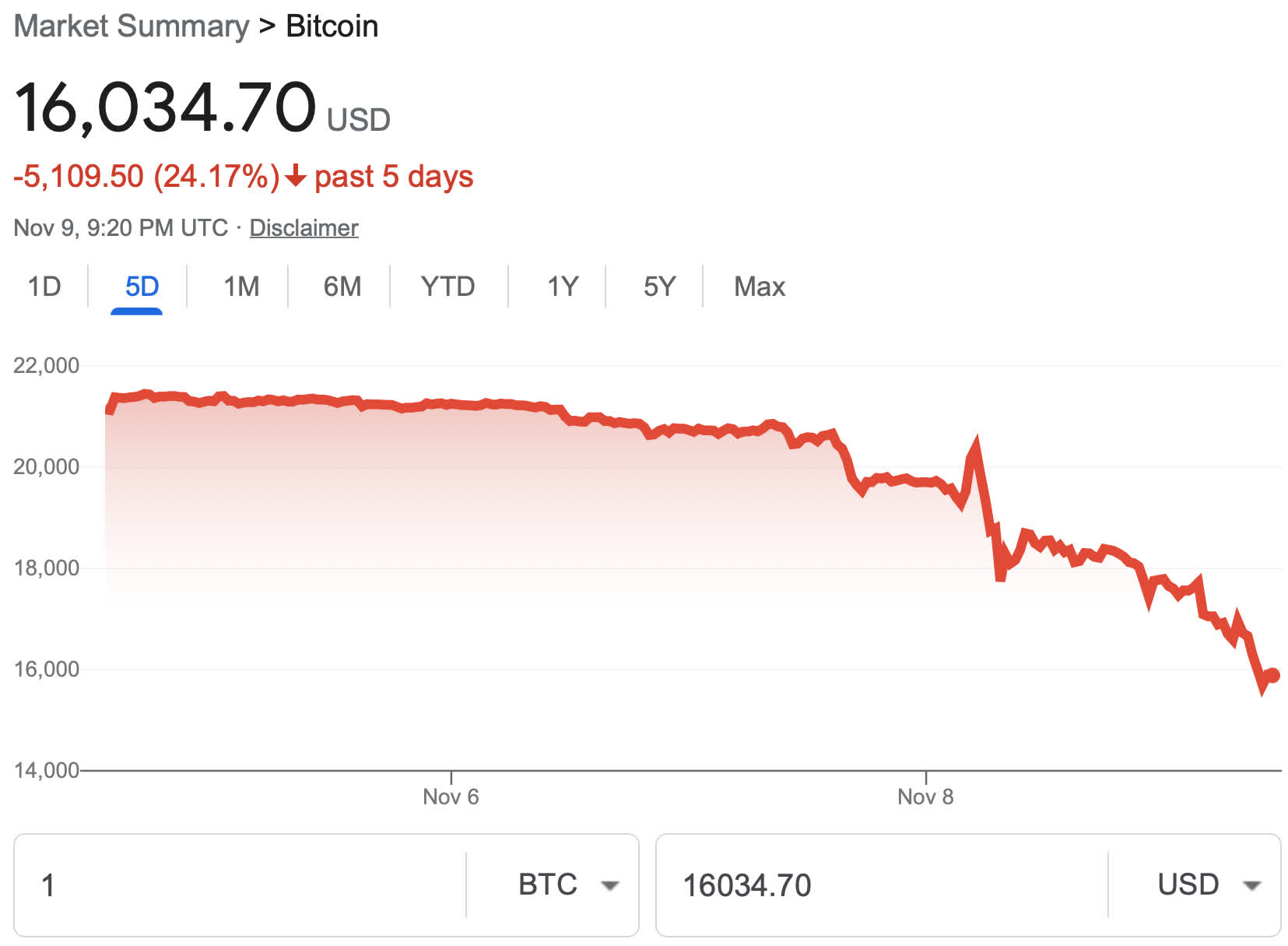

Forbes notes the shakeup caused a ripple effect that saw Bitcoin value fall 10 percent on Tuesday and another seven percent Wednesday to $17,056 --- a two-year low. Bitcoin has continued its fall since this morning's low and sits at $16,034.70 as of this writing, more than $5,000 lower than it was trading a week ago.

Before the scare, rival exchange Binance was reportedly in talks to merge with FTX but backed out of the deal. In response, Binance CEO Changpeng Zhao often referred to as just CZ, issued a tweet containing a memo he sent to all Binance employees.

According to CZ, Binance had nothing to do with FTX's crisis. He emphasizes that this was not some "master plan" to back out of the deal. Due diligence is still underway, indicating that the agreement is not canceled, despite what CoinDesk's "anonymous sources" say.

"DO NOT trade FT tokens. If you have a bag, you have a bag. DO NOT buy or sell," CK advised.

Probably a wise decision considering the coin has nowhere to go but up or out. Bankman-Fried's FTT dropped seven percent, on Wednesday. Tokens were holding relatively steady last week, hovering at around $25. As of publication, the tokens are valued at $2.50, a 90-percent freefall. Selling at this time would virtually be a total loss unless you invested way back in September 2019 when it was trading for under $2.

The repercussions were also felt throughout the rest of the sector. Ethereum slid nine percent on Wednesday and is 30 percent lower than a week ago. Stock in Coinbase dumped 18 percent of its valuation in the last two days nearing an all-time low.

"Bernstein analysts called the dip a result of a 'seismic shift' in the industry," Forbes noted.