A hot potato: The crypto winter isn't thawing; it's getting colder. That's the opinion of a cryptocurrency exchange CEO who has laid off 30% of his staff over the past two days, a trend that's been pervasive within the industry for many months and has been exacerbated by FTX's collapse. How much worse could things get? One scenario predicts Bitcoin falling as low as $5,000, a level not seen since March 2020.

The world's most popular crypto has been on a downward trajectory since it hit that near-$69,000 high back in November 2021. The industry was rocked following the collapse of TerraUSD in May, and the recent implosion of exchange FTX sent seismic shockwaves throughout marketplaces.

The so-called crypto winter has seen digital asset prices fall (including those of NFTs), lawsuits, bankruptcies, and job losses. Joining crypto exchange giant Kraken in laying off staff are Bybit and Swyftx, which are reducing their headcounts by 30% and 35%, respectively, writes Bloomberg.

Swyftx CEO Alex Harper told employees in a letter that the industry could see more "black swan-type events," while Bybit boss Ben Zhou warned, "we are entering into an even colder winter than we had anticipated."

Standard Chartered's global head of research, Eric Robertsen, wrote that one of those surprise black swan scenarios is Bitcoin falling even further next year, down to $5,000. That pessimism is shared by BlackRock Inc. CEO Larry Fink, who believes "most" crypto companies will not survive the repercussions of FTX's collapse.

The European Central Bank, which has never tried to hide its disdain for crypto, last week called Bitcoin "cumbersome, slow and expensive," adding that it is on the "road to irrelevance" and has "never been used to any significant extent for legal real-world transactions." The comments came after ECB President Christine Lagarde said crypto is both based on and worth "nothing" in May.

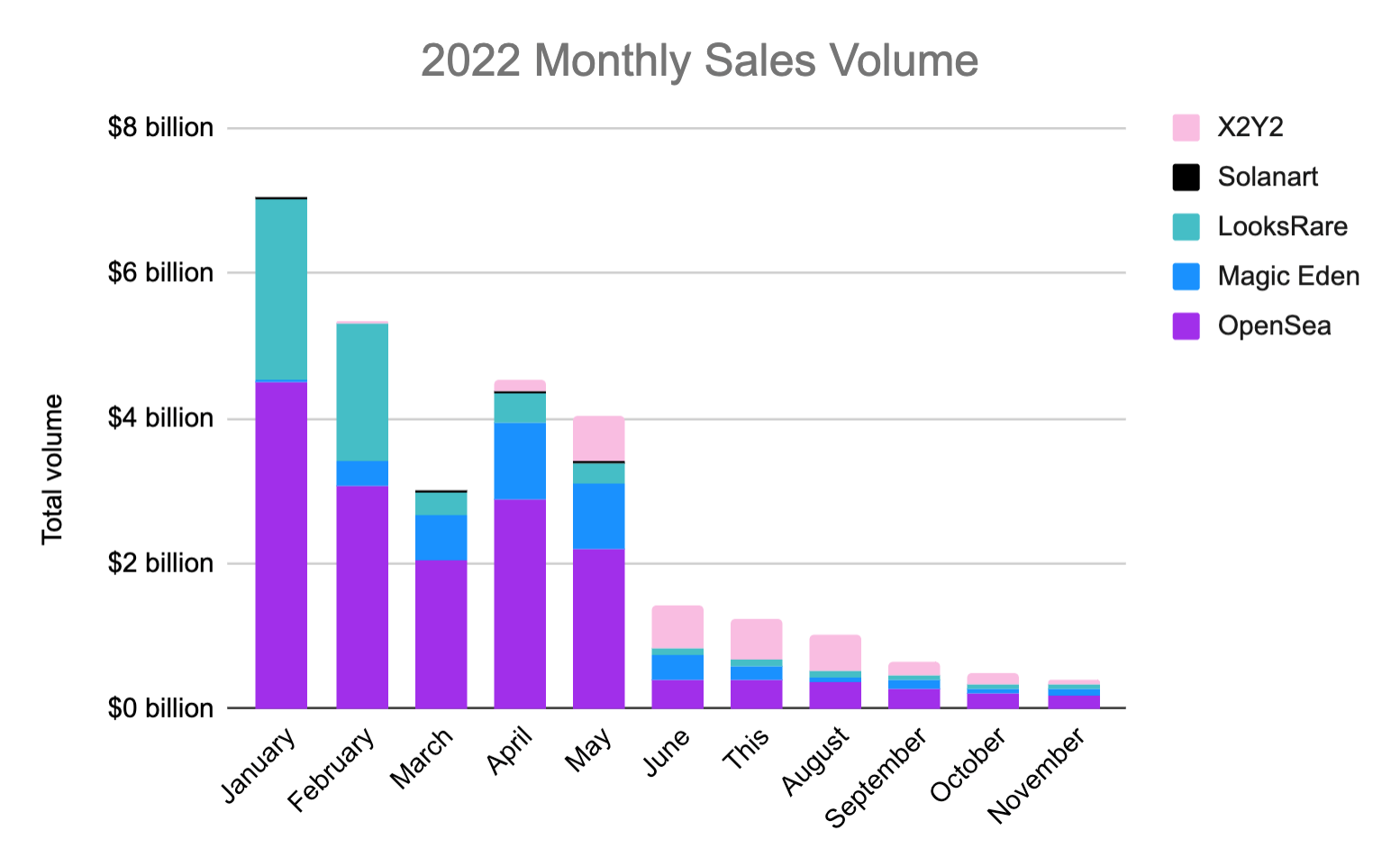

Source: Balthazar, DappRadar

According to NFT gaming platform Balthazar DAO's latest NFT Marketplace Update, November set a new record low for monthly NFT sales across the top 5 marketplaces combined this year ($394.02 million). Case in point: Justin Bieber's Bored Ape NFT that cost him $1.2 million at the start of 2022 was recently valued at $69,000.