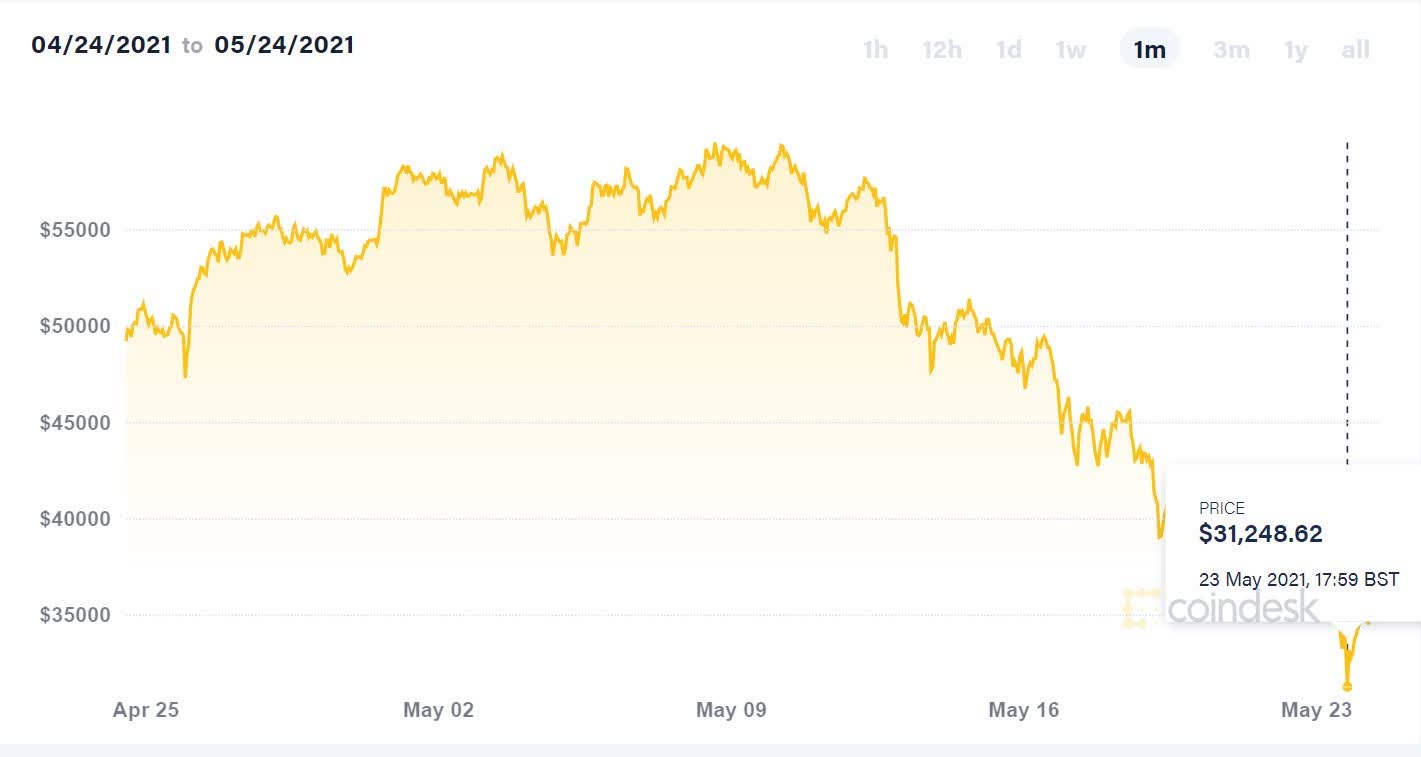

What just happened? It's starting to look as if the meteoric rise Bitcoin has enjoyed since the end of last year is coming to an end. The crypto's price has tumbled by around 50% since mid-April, a decline that's been exacerbated by top cryptocurrency miners, including HashCow and BTC.TOP, suspending all or part of their China operations after the country announced another crackdown.

Bitcoin has been having a bit of a rollercoaster recently. It hit a record $65,000 in April but took a big hit when Elon Musk said Tesla would no longer accept it as payment for its vehicles due to concerns over the environmental impact of mining. The CEO then hinted that the EV giant had sold, or was planning to sell, its Bitcoin holdings, sending the price down further. Musk later confirmed that Tesla had not sold its BTC.

On Friday, a State Council committee led by Vice Premier Liu He announced the crackdown on virtual currencies as part of efforts to curb financial risks, writes Reuters. It is the first time China's cabinet has targeted mining, a massive business in a country that accounts for up to 70% of the world's crypto supply.

Huobi Mall, part of cryptocurrency exchange Huobi, suspended both crypto mining and some trading services to new clients from mainland China. It asked customers via its official Telegram channel "not to worry and calm down."

Crypto mining pool BTC.TOP, meanwhile, announced the suspension of its China business, citing regulatory risks. "In the long term, nearly all of Chinese crypto mining rigs will be sold overseas, as Chinese regulators crack down on mining at home," wrote founder Jiang Zhuoer. Additionally, crypto miner HashCow said it would suspend new businesses in China.

Despite its importance in the industry, China's government is no fan of crypto; it banned exchanges in 2017.

The true battle is between fiat & crypto. On balance, I support the latter.

--- Elon Musk (@elonmusk) May 22, 2021

China's announcement saw Bitcoin crash to just over $31,000 yesterday, BTC's lowest price since early January, though it has rallied slightly to around $36,000 at the time of writing. Ironically, its rebound was helped in part by Elon Musk tweeting that he prefers crypto to traditional fiat currencies.

Image credit: Ms. Li