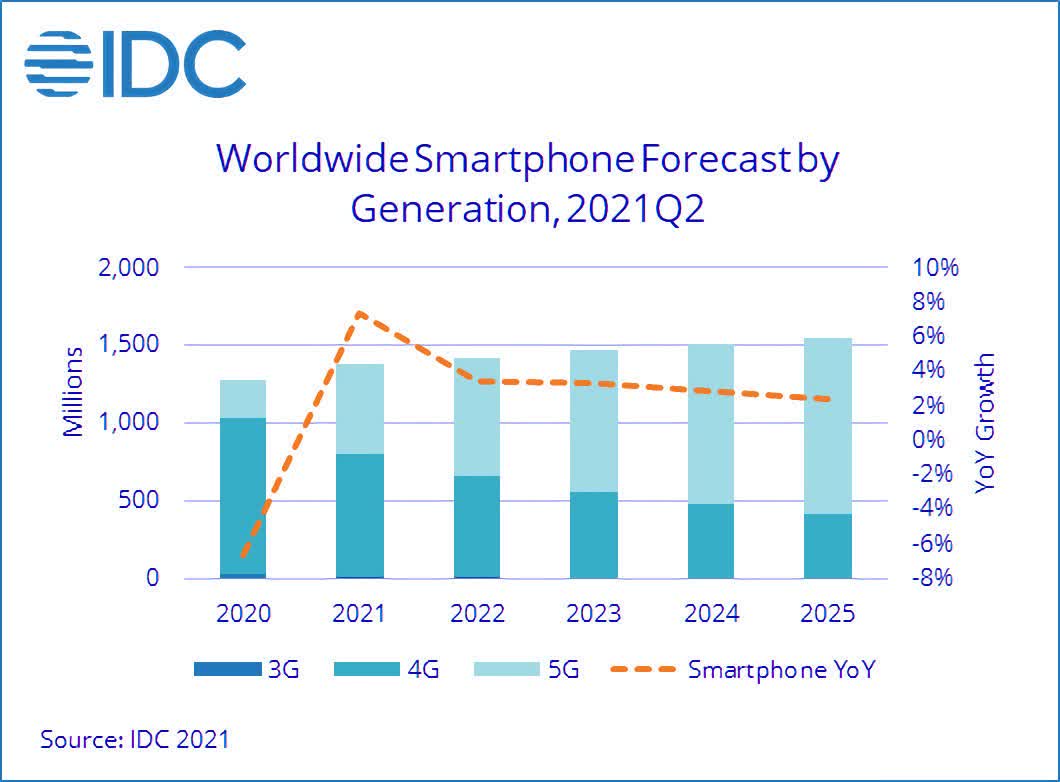

In brief: Despite the global chip shortage, smartphone shipments are expected to increase 7.4% this year to reach 1.37 billion units. Much of that came from iOS devices, which saw almost double the growth of Android smartphones.

Research firm IDC writes that Apple devices will show an impressive 13.8% growth in 2021, while Android should reach 6.2%. The upward trend in overall shipments is expected to continue, albeit at a slower pace, across the next few years: 3.4% in 2022 and 2023, respectively.

It's important to note that the pandemic had a substantial negative impact on smartphone shipments last year, but the 2021 predictions still show slight growth compared to 2019. Shipments in the world's largest markets---China, the United States, and Western Europe---are set to be down from two years ago. However, emerging markets such as India, Japan, the Middle East, and Africa are helping offset the falling figures.

"The smartphone market was better prepared from a supply chain perspective heading into 2020 given almost all regions were expecting to grow and vendors were preparing accordingly," said Ryan Reith, group vice president with IDC's Mobility and Consumer Device Trackers. "2020 was a bust due to the pandemic but all of the top brands continued forward with their production plans with the main difference that the timeline was pushed out. Therefore, we are at a point where inventory levels are much healthier than PCs and some other adjacent markets and we are seeing the resilience of consumer demand in recent quarterly results."

5G devices can take a lot of the credit for the uptick in shipments. The handsets have a higher average selling price (ASP) than 4G phones, and with the latter's ASP continuing to decline, 5G shipments are set to grow 123.4% to 570 million units this year. China continues to lead the way with a 47.1% share of the 5G market, followed by the US with 16%. By the end of next year, 5G units are predicted to make up more than half of all smartphone shipments, boasting a 54.1% share.

IDC writes that shipments for phones priced over $1,000 saw 116% growth in Q2 compared to the same quarter last year, which isn't too surprising given the lockdowns and concerns many had over their jobs. 2021 has also seen the AVG of phones increase 9% as more buyers opt for expensive 5G models.