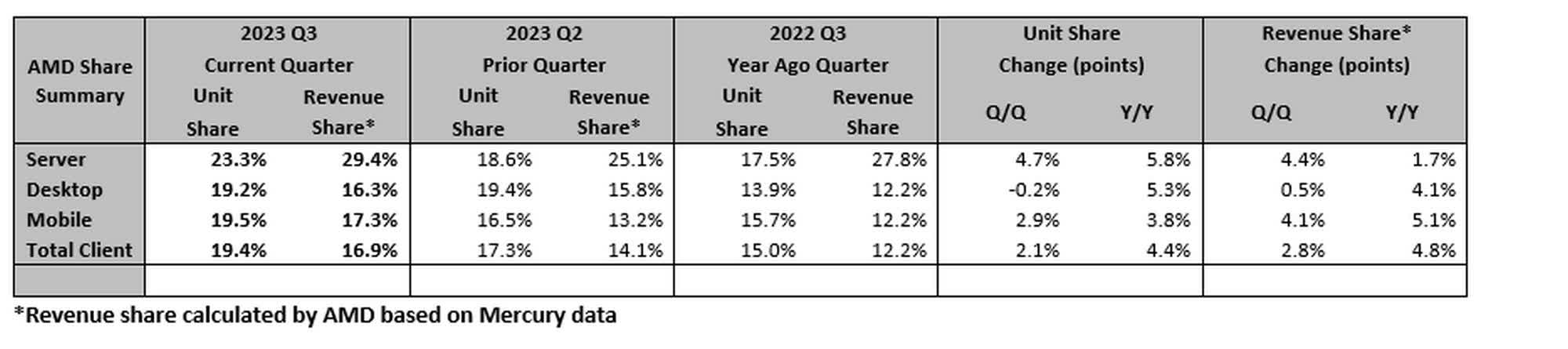

What just happened? AMD has gained CPU market share over the past quarter across desktops, laptops and servers. The report comes from PC hardware market research firm Mercury Research, who has split the results in two categories: revenue share and unit share.

According to Mercury Research (via Tom's Hardware), AMD gained 5.8 percent unit share in desktops, 3.8 percent in laptops, and 5.8 percent in servers. In terms of revenue share, Team Red gained 4.1 percent in desktops, 5.1 percent in laptops, and 1.7 percent in servers. The report does not mention competitors by name, but the global PC industry only has one other major CPU supplier, Intel, which has a major stake in all the market segments.

While Intel and AMD make x86 processors for PCs, Qualcomm offers Arm-based SoCs for Windows notebooks, but its market share is minuscule by comparison. So, while the report doesn't say anything about the market share of Intel or Qualcomm, it is fair to assume that most of AMD's gains came at Intel's expense.

Based on this data, AMD believes its desktop market share was at 19.2 percent in Q3 2023, a 5.3 percentage increase from the 13.9 percent share during the same period last year. In the laptop market, the company's estimated market share was 19.5 percent, up from 15.7 percent during Q2 2022. In the server market, AMD garnered a 23.4 percent share, up from 17.5 percent during the year-ago quarter.

The report attributes AMD's strong showing to its 4th-gen EPYC and Ryzen 7000-series processors, both of which were released over the past year. It is interesting that the Ryzen 7000 lineup has been such a hit for AMD, as it requires a total platform upgrade to socket AM5 and DDR5 memory. In comparison, Intel's 13th- and 14th-gen Raptor Lake processors still use the same LGA 1700 socket as its 12th-gen Alder Lake CPUs, and support both DDR4 and DDR5 RAM, meaning people do not have to invest in new motherboard and RAM to jump to the latest platform.

The global PC market is starting to show signs of recovery after multiple quarters of negative growth. Over the past few months, sales showed a marked upsurge, thanks to increased consumer activity for the back-to-school season. With the holiday season now in full swing, sales should remain strong for PC OEMs, which is good news for chipmakers like Intel and AMD.